The European Central Bank is poised to deliver what could be the penultimate increase in its unprecedented campaign of interest-rate hikes.

Economists and markets overwhelmingly expect the deposit rate to be lifted by a quarter-point to 3.5% on Thursday, leaving them focused on guidance for how much further officials expect to raise borrowing costs with inflation still three times the 2% target.

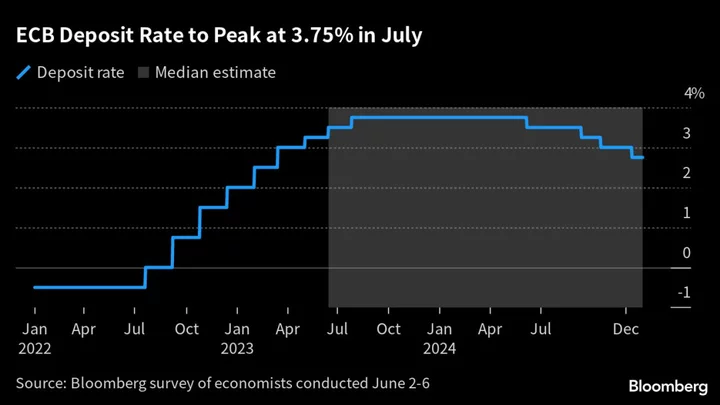

The consensus among analysts is for one last hike next month, bringing monetary tightening since last July to 425 basis points — a scenario many policymakers signal they could support. Money-market pricing implies a final quarter-point move in July or September.

Raising at both of those meetings can’t be excluded — especially if updated quarterly projections show inflation lingering for longer. But such a commitment at this juncture would be a surprise.

Speaking in the wake of unexpected hikes in Canada and Australia — and after the Federal Reserve on Wednesday refrained from boosting rates after 10 straight increases — ECB President Christine Lagarde will probably reiterate that future steps hinge on the price outlook, underlying inflation and how the economy digests action to date.

She’s also set to confirm a halt from July in reinvestments under the ECB’s older quantitative-easing program, as nearly €500 billion ($540 billion) of cheap loans to banks mature.

The ECB’s policy announcement is due at 2:15 p.m. in Frankfurt, with Lagarde’s news conference to take place half an hour later.

- Follow the ECB TLIV blog here

Interest Rates

Economists surveyed by Bloomberg are confident the ECB will raise rates sufficiently to defeat inflation but not so much that the euro-zone economy crashes. They expect the deposit rate to peak at 3.75% in July, and to remain at that level for almost a year.

Such an outcome would be welcomed by the Governing Council’s dovish members. Spain’s Pablo Hernandez de Cos and Greece’s Yannis Stournaras both say hikes are nearing their end, with even France’s more centrist Francois Villeroy de Galhau arguing similarly.

More hawkish officials like Ireland’s Gabriel Makhlouf and the Netherlands’s Klaas Knot say they’re open-minded about September. Bundesbank President Joachim Nagel and Austria’s Robert Holzmann have signaled they’d prefer another move then.

Clues from Lagarde on how much tightening remains would require her going beyond her usual wording of there still being “more ground to cover.”

Economic Outlook

Much will depend on how the euro-area economy behaves after enduring a mild winter recession, with evidence building that the ECB’s rate increases are having an effect.

Inflation surprised to the downside last month, while the core gauge that excludes food and energy costs hit a four-month low of 5.3% — even if Lagarde has warned that the peak may yet be ahead.

Read more: ECB Officials Urge Higher Rates Even as Inflation Retreats

Credit standards, meanwhile, have tightened significantly and loan demand has slumped — trends that have been tempered somewhat for consumers by a strong labor market and pandemic-era savings.

Updated projections will highlight how policy transmission will affect economic growth and inflation through 2025. Analysts surveyed by Bloomberg don’t expect major revisions to the outlook for that year, suggesting price pressures will remain too strong for comfort.

Balance Sheet

Plans to discontinue reinvestments under QE as of July are set to be officially confirmed, with about €28 billion of debt maturing on average each month over the next year.

That decision will bring with it the end of efforts to green the ECB’s corporate bond portfolio — unless officials decide to sell securities from carbon-intense businesses and buy more climate-friendly ones instead, a practice it’s so far avoided.

The impact of quantitative tightening on the ECB’s balance sheet, which still exceeds €7.7 trillion, will be comparatively small. The bigger impulse will come from banks repaying three-year loans that were extended at the height of the pandemic.

While some economists and investors have expressed concern that the region’s lenders — particularly those in Italy — could struggle to mobilize the almost €500 billion needed, Lagarde has pushed back against suggestions the ECB may have to step in.

It wouldn’t be a surprise, she told reporters last month, if demand at the ECB’s regular lending operations increases as a result.

--With assistance from Alexander Weber, Joel Rinneby, Barbara Sladkowska and James Hirai.

(Updates with market bets in third paragraph.)