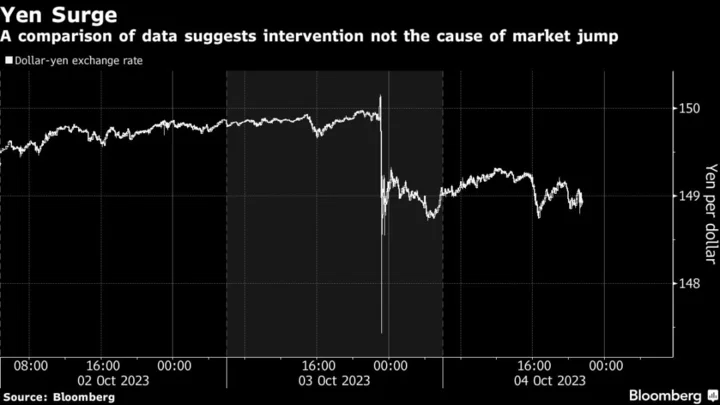

Japan likely refrained from intervening in the currency market to prop up the yen earlier this week, according to an analysis of central bank accounts.

During last year’s massive yen buying operations, there were noticeable discrepancies in Bank of Japan current account figures compared with private money broker estimates of government fund flows. But the BOJ’s projections for its balance on Thursday were in line with forecasts, suggesting Japan didn’t step into markets after the yen weakend past 150 per dollar.

“It’s highly likely intervention didn’t take place,” said Yosuke Takahama, chief manager at money broker Central Tanshi Co., adding that the current account figures for Thursday aren’t so different from prior projections. If Japan had intervened on Tuesday there should be a large negative figure for government flows, he said.

Among other possible explanations for the sharp surge that briefly strengthened the currency are a combination of jittery markets and trading algorithms responding to the yen’s slide through the key 150-per-dollar threshold.

A rate check by the central bank or an option-related trade that unsettled markets are among other possible causes, according to Bloomberg Economics’s Taro Kimura.

Senior Japanese officials declined Wednesday to confirm whether they intervened, likely as part of a strategy to keep traders guessing about their actions and bolster their psychological defense against speculators.

While analysts said an intervention wouldn’t have been surprising after months of warnings, they largely shared the view that the events on Tuesday didn’t have the same kind of impact the finance ministry made via its series of three interventions last year. Those totaled more than $60 billion.

“Even if there was no intervention, it demonstrates the nervousness among market players about the yen around 150,” said Takeshi Ishida, currency strategist in Tokyo at Resona Bank Ltd. “It will take a while to dispell this fear of what is lurking in the shadows.”

The projected increase in the BOJ’s current account of around 10 billion yen ($67.2 million) from the government on Thursday, largely tallied with a forecasted range by brokers including Central Tanshi. The early BOJ figures were released Wednesday evening in Tokyo.

The calculation offers only ballpark figures rather than specific amounts. The same math projected the size of intervention on Oct. 21 last year at as much as 5.5 trillion yen. Official figures released later showed it turned out to be 5.6 trillion yen.

The yen traded around 148.50 against the dollar Thursday morning. The market jump that prompted speculation of intervention took place Tuesday after the currency weakened to 150.16 then rapidly strengthened as far as 147.43.

The ministry will disclose its total amount of currency intervention for October at the end of this month. More specific details on daily intervention and currency pairs for this quarter is usually announced around February.

“Japanese authorities want to buy time until the strong dollar trend turns around and stops pushing the yen down,” said Tomo Kinoshita, global market strategist at Invesco Asset Management. “It’s hard to push back against this current global dollar trend so the cautiousness among finance ministry officials is warranted.”

--With assistance from Issei Hazama and Daisuke Sakai.

(Adds analysts’ comments)