Thailand is preparing contingency plans to deal with a potential drought that could last years and squeeze global supplies of sugar and rice.

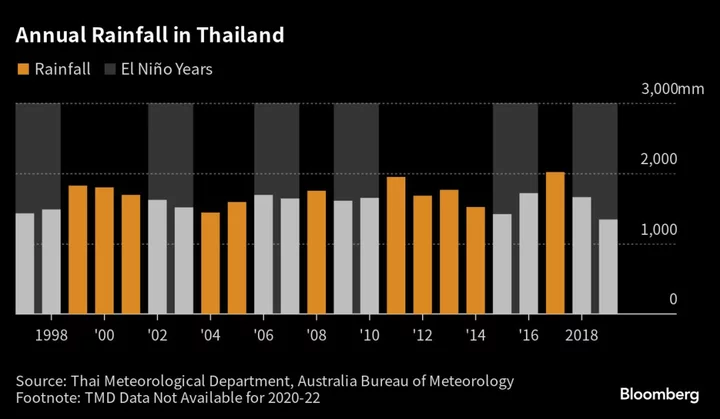

Rainfall across the nation may be as much as 10% below average this monsoon season, and the onset of the El Niño weather pattern could lower precipitation even further over the next two years, according to government officials. Thailand is facing widespread drought conditions from early 2024, authorities have warned.

The dire outlook has prompted Thai authorities to ask farmers to restrict rice planting to a single crop to conserve water, and sugar producers see output falling for the first time in three years. A drought is certain to fuel inflation in the Southeast Asian nation as the cost of vegetables, fresh food and meat get pricier on reduced harvests and more expensive animal feed.

Prime Minister Prayuth Chan-Ocha has asked state-run power utility Electricity Generating Authority and the Office of Natural Water Resources to help draw up contingency plans to conserve water. So far in 2023, the nation’s rainfall has been 28% below the same period last year, according to official data.

El Niño can lead to drier conditions in parts of Asia and Africa, and heavy rains in South America, damaging a wide range of crops globally. Previous El Niños have resulted in a marked impact on global inflation and hit gross domestic product in nations from Brazil to India and Australia.

Thailand is seeking to nurture a rebound in economic growth that’s already facing headwinds from a slowdown in China, the nation’s largest trade partner, and a prolonged drought may scupper efforts to keep inflation under check. Thailand has already grappled with record heat this year.

“El Niño will pose a bigger worry on growth than inflation,” said Euben Paracuelles, an analyst at Nomura Holdings Inc. “Thailand is a large food exporter, with only half of total output consumed domestically. So the buffers could help limit the near-term inflation impact, alongside government price controls and subsidies.”

If El Niño turns severe, it could shave off 0.2 percentage point of gross domestic product this year because drought conditions could coincide with seasonal production in the second half, especially for rice, Paracuelles said. The central bank forecasts Thailand to clock GDP growth of 3.6% this year, accelerating from 2.6% in 2022.

Read More: Here’s What to Know About El Niño and the Weather: QuickTake

Power demand in Thailand hit a record in April when some regions saw all-time high temperatures, forcing companies and households to increase the use of air-conditioning to escape the sweltering heat.

The bigger, global impact from below-average rainfall in Thailand will be the hit to crops such as sugar and rubber, and could even threaten the nation’s position as the world’s second-biggest supplier of rice. Shipments tumbled a third to 7.6 million tons in 2019, the first year of the previous El Niño.

Sugar cane is a sturdy crop, but the nation’s millers have forecast a decline in output. That will cut the supply to the world market and further fuel a rally in refined sugar prices that are hovering around a decade-high.

The nation produced about 11 million tons of sugar in the 2022-23 season and is estimated to have exported about 80% of its output.

Thailand’s lack of long-term mitigation efforts to deal with floods and droughts will likely aggravate the impact of extreme weather on the nation, according to the World Bank.

“The frequency of floods and droughts, and the high human and economic cost associated with them, make climate change adaptation and water management important in Thailand,” said Fabrizio Zarcone, the World Bank’s country manager for Thailand. “A more robust framework prioritizing risk mitigation planning, investing in water resources infrastructure, and managing land and water use is needed.”

--With assistance from Kevin Dharmawan.