The dollar weakened and Treasuries extended their November rally on speculation the Federal Reserve is done with interest-rate hikes and will be able to ease policy next year.

The Japanese yen and New Zealand dollar led gains as the greenback lost ground against all of its Group-of-10 peers. Fed swaps are anticipating over 100 basis points of rate cuts by the end of 2024 after Governor Christopher Waller said the bank is well positioned to push inflation to a 2% target. Billionaire investor Bill Ackman said the Fed could begin cutting interest rates as soon as the first quarter, sooner than markets expected.

“The US dollar has been weakening across the board as the market becomes increasingly convinced that the next move from the US central bank will be to cut interest rates,” said Fawad Razaqzada, market analyst at City Index and Forex.com. “Markets are getting a bit over excited, but traders are just looking to take advantage of the momentum — and will be asking questions later.”

In a speech entitled “Something Appears to Be Giving,” Governor Waller — one of the most-hawkish officials — said he’s “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.” While acknowledging the many uncertainties, his colleague Michelle Bowman refrained from telegraphing an imminent hike.

Two-year yields dropped 15 basis points to around 4.73% Tuesday while a Bloomberg gauge of the dollar fell to its lowest since August and is on track for its worst month in a year. The New Zealand dollar held gains ahead of a key policy decision. Oil held its largest gain in a week as OPEC+ appeared to be at an impasse over production quotas before a meeting on Thursday..

In stocks, Australia’s benchmark opened higher while futures pointed to a decline for Japan and Hong Kong was little changed. Contracts for the S&P 500 were flat after the index swung between small gains and losses to close with a small advance — it is still headed toward one of its biggest November gains on record. Bitcoin traded back above $38,000.

Read: Treasury 7-Year Note Auction Tails After Rally Into Bid Deadline

On the economic front, US consumer confidence rose for the first time in four months in November, aided by more optimistic views about the outlook for the labor market. Home prices hit a fresh record high, according to seasonally adjusted data from S&P CoreLogic Case-Shiller.

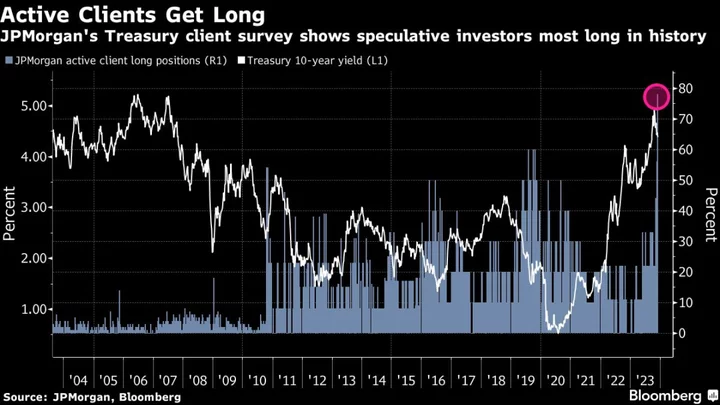

The most-active investors in the Treasury market are as bullish as they’ve ever been, according to a weekly survey conducted by JPMorgan Chase & Co. since 1991.

JPMorgan’s Treasury client survey for the week ended Nov. 27 found that 78% of active clients were positioned long relative to their benchmark, up from 56% the previous week. None of them were positioned short for a second straight week, for a 78% net long position that was the biggest in the history of the survey. The remaining respondents were neutral.

Meantime, the recent sharp pullback in volatility as year-end approaches creates hedging opportunities given the cloudy outlook for equities, according to Goldman Sachs Group Inc. strategist Christian Mueller-Glissmann.

“After the recent equity rally, we believe there is an attractive entry point to hedge the risk of a retracement,” he noted. “Cross-asset volatility has continued to reset lower, supported by markets further embracing the ‘inverse’ Goldilocks backdrop in the US with faster-than-expected inflation normalization and growth remaining resilient.”

Key events this week:

- New Zealand rate decision, Wednesday

- OECD releases biannual economic outlook, Wednesday

- Eurozone economic confidence, consumer confidence, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- US wholesale inventories, GDP, Wednesday

- Cleveland Fed President Loretta Mester speaks, Wednesday

- Fed releases its Beige Book, Wednesday

- China non-manufacturing PMI, manufacturing PMI, Thursday

- OPEC+ meeting, Thursday

- Eurozone CPI, unemployment, Thursday

- US personal income, PCE deflator, initial jobless claims, pending home sales, Thursday

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:31 a.m. Tokyo time. The S&P 500 rose 0.1%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.3%

- Nikkei 225 futures fell 0.2%

- Hang Seng futures were little changed

- Australia’s S&P/ASX 200 rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.1% to $1.1005

- The Japanese yen rose 0.3% to 147.06 per dollar

- The offshore yuan was little changed at 7.1292 per dollar

- The Australian dollar rose 0.1% to $0.6657

Cryptocurrencies

- Bitcoin fell 0.3% to $37,861.48

- Ether was little changed at $2,054.75

Bonds

- Australia’s 10-year yield declined six basis points to 4.44%

Commodities

- West Texas Intermediate crude rose 0.2% to $76.59 a barrel

- Spot gold rose 0.1% to $2,043.84 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.