The US dollar tumbled by the most in a year after soft inflation data led traders to ramp up bets the Federal Reserve will start cutting interest rates by mid-2024, sending Treasury yields plunging.

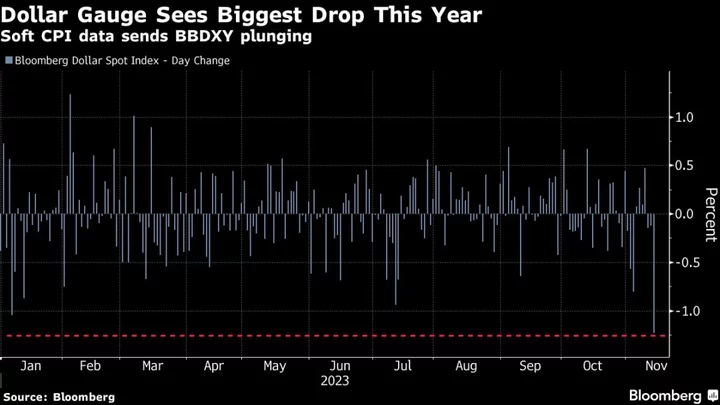

A Bloomberg gauge of the dollar tumbled as much as 1.3% on Tuesday, the largest such drop since November 2022. It stayed close to the previous day’s close on Wednesday, helping propel the won and ringgit to the top of Asia’s currency rankings. The moves followed a report that showed US headline and core inflation in October slowed more than economists had forecast.

The release of the data set off a major shift across world financial markets, with traders anticipating that the Fed’s aggressive rate hikes will succeed in reining in the worst inflation surge since the 1980s. That sent bond yields sliding, sapping the incentive for overseas investors to shift money to the US and fueling a rally in risk assets like US and emerging-market stocks.

The dollar had rallied for much of this year on the back on rising Treasury yields. But that dynamic kicked into reverse Tuesday, when the dollar lost ground against almost all of the world’s major currencies as traders priced in expectations that the Fed will cut its benchmark rate by about half a percentage point by July.

“Over recent weeks, it seemed as if there was a reluctance to buy into the dollar on data which supported the Fed’s higher-for-longer narrative,” Simon Harvey of Monex said. “It isn’t surprising to see European and high-beta FX rally against the dollar as rate cut expectations are brought forward.”

Among the so-called Group-of-10 currencies, the Australian dollar rallied as much as 2.1% on Tuesday, the largest boost since January, the euro climbed as much 1.8% in its biggest intraday move in a year. The currencies slightly pared their moves on Wednesday.

Among emerging Asian currencies, the won rose as much as 1.9% to lead gains on Wednesday, followed by the Malaysian ringgit, which advanced 1.3%.

The yen pulled back from close to a 33-year low against the greenback, a level that had traders braced for possible intervention from Japan to support the beleaguered currency. Japanese Finance Minister Shunichi Suzuki had warned repeatedly this week that the government will respond to excessive moves.

Hawkish Bets Fade

Fed swap contracts indicate that the odds of another rate increase have fallen to nearly zero with the timing of a first anticipated rate cut pulled up to May or June. Treasuries rallied across maturities on Tuesday, with the yield on the five-year tenor falling as much as 25 basis points to a low of 4.41%. The 10-year US benchmark was little changed at 4.45% on Wednesday.

The options market sees the drop in the dollar helping to balance currency positions. An index of three-month volatility on the index sunk to its lowest level since February 2022.

“The markets have moved to price in more rate cuts next year and pulling forward the start to the easing cycle,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi US. He said there is a “lack of fundamental data in the short term, the high probability of no hike in December and a market that is wrong footed that could give this rally some legs.”

--With assistance from Anya Andrianova and Marcus Wong.

(Updates with Asia FX moves in paragraph two, won in paragraph seven and Treasuries in paragraph nine.)