From Brazil to China, critics of the dollar-led world order notched a symbolic win this week after Fitch Ratings’ landmark move to strip the US of its AAA halo.

Blaming ballooning deficits, fiscal brinkmanship and more, the credit ratings firm stoked fresh fears in Washington that America’s stature in the global economy is diminishing.

Still, the post-Fitch reaction in the currency market tells a more reassuring story. Not only did the greenback weather the downgrade, it rose Wednesday as data showed that a soft landing may be nigh, while much of the world including Europe remains in a growth funk.

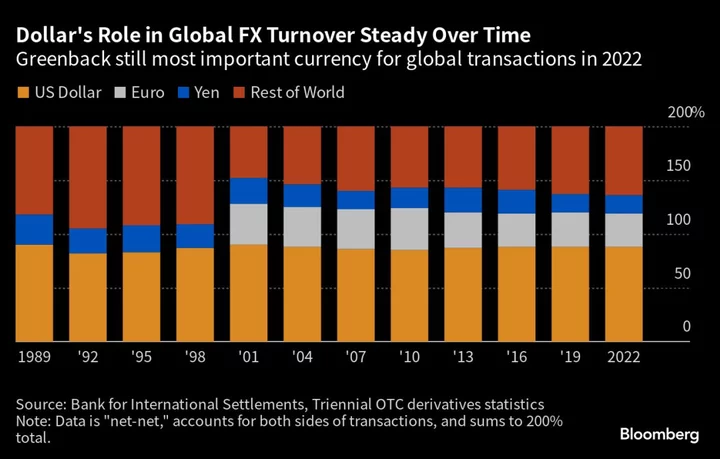

Far from deficits leading to currency ruin — as Wall Street worrywarts who cling to textbook theory tend to argue — the dollar’s sway across the international financial system remains unrivaled.

And if past is prologue, take note. When debt-ceiling drama in 2011 spurred S&P Global Ratings to strip the nation of its top-tier status — a move that has never been reversed — the greenback was unscathed in the end. In fact, the Bloomberg Dollar Spot Index ended the year 7% higher, and is up more than 30% since.

“The dollar is a safe haven because it’s such a large transactional currency,” said Jane Foley, head of FX strategy at Rabobank. “Yes, over time that may be eroded but we’re looking at 20, 30 or 40 years.”

Deeply embedded in the flow of commerce and money across borders, the dollar has famously endowed Washington with a multitude of privileges in trade, capital markets and international security — much to the frustration of geopolitical foes.

On Wednesday, executives at Fitch acknowledged that the US debt burden has to be weighed against the sheer dominance of the greenback in trade and finance. The dollar’s role as a reserve currency is “unparalleled,” said Richard Francis, the company’s co-head of Americas sovereign ratings on Bloomberg TV.

Going forward, the Fitch move could yet spark currency volatility and the consequences for asset allocation are ultimately unknown. Meanwhile, there are warnings that markets are overly sanguine on the politics. In June, the US was pushed closer to a historic default after lawmakers struggled to agree on lifting the government’s borrowing limit.

In an emailed response to questions from Bloomberg News after the downgrade, James McCormack, global head of sovereign and supranational ratings at Fitch, pointed to political dysfunction, saying that firm is “not confident in policy measures being agreed and implemented to address the fiscal deterioration.”

Just hours after the ratings action, two former US Treasury secretaries, Hank Paulson and Timothy Geithner, urged Washington policymakers to address debt challenges, with deficits projected to total $20 trillion over the coming decade.

As such, fears of a a post-dollar future are palpable in the hallowed halls of DC thinktanks and beyond. The greenback accounted for just under 60% of central banks’ official currency reserves in the fourth quarter of last year, lower than the historic norm, in an era where China and Russia, among other nations, attempt to de-dollarize.

And with growing geopolitical tensions, the likes of ex-Credit Suisse AG strategist Zoltan Pozsar argue that the hegemony of the greenback is likely on borrowed time.

“The downgrade has little new information but still reinforces the perception that the dollar’s global dominance rests on a fragile pedestal,” said Eswar Prasad, professor at Cornell University and author of The Dollar Trap.

Yet the absence of a meaningful rival will delay the day of reckoning, per Prasad.

“The downgrade could in principle add to the dollar’s death by a thousand cuts but that day of reckoning for the currency’s supremacy in international finance, if it ever comes, is a long way away,” he said.

Read more: Pristine AAA Bond Universe Just Got a Whole Lot Smaller

Read more: Debt-Ceiling Drama Threatens Supremacy of Already Wobbly Dollar

A Bloomberg dollar gauge peaked at all-time highs last September, causing pain for indebted borrowers around the developing world. It has subsequently fallen 9% as the Federal Reserve gets closer to the end of its rate-hiking cycle.

With China holding a tight grip on its capital account, it’s not easy to imagine a viable pretender to the dollar’s throne emerging anytime soon. Meanwhile a surge of energy and infrastructure investment could boost the productive capacity of America’s economy — attracting fresh overseas demand for dollar assets.

“There is a case that on the margin this reduces the US dollar’s appeal as a reserve alternative,” said Timothy Graf, head of EMEA macro strategy at State Street Bank & Trust Co., referring to the Fitch move. “But its peers, other than Germany, have similar or weaker credit profiles.”

In that sense, there are 2011 echoes. Back then, S&P’s downgrade failed to hurt the dollar, largely due to heavy debt burdens in Europe and Japan, according to Macquarie Group Ltd. strategists including Thierry Wizman.

“Today too, high debt is a problem plaguing many DMs and EMs,” they wrote in a note.

Author: Alice Atkins, Carter Johnson and Enda Curran