A group of bonds issued almost 40 years ago by Norwegian lender DNB Bank ASA are surging in value as it plans to redeem them after spending years battling bondholders to avoid doing so.

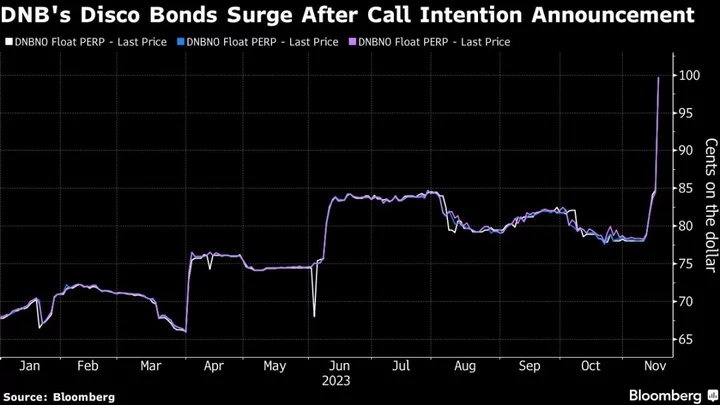

Three notes worth a total of $565 million, and known in the market as discounted perpetuals or discos, rose by about 15 cents on the dollar to approach face value on Thursday. That followed an announcement by DNB that it intends to redeem the notes by the end of February.

The decision is a surprise twist in a long-standing saga that pitted investors against the bank. DNB wanted to keep the bonds as a cheap source of money, betting on a potential rule by the Norwegian finance ministry to create a place in its capital structure for this obsolete type of debt. Instead, bondholders look set for a windfall given they were trading at a deep discount.

The perpetual notes were sold back in the mid-1980s as a source of regulatory capital. After multiple changes in bank regulations over the years, they lost this status, but wafer-thin spreads made them attractive to hold on to. The bank’s management repeatedly stated its commitment to keeping them outstanding.

The move “will delight bondholders,” wrote Jennifer Ray, head of northern European banks at credit research firm CreditSights, Inc., in a note. “The expected amendment to Norwegian law previously relied upon in DNB’s original decision not to redeem the instruments will not now go ahead.”

Thor Tellefsen, head of long term funding at DNB, declined to comment.

Earlier this year, DNB launched a vote to change the rate used on the bonds to calculate interest from the now-dead Libor to a replacement rate. Investors, who had been grappling with a lack of clarity on where these junior bonds sit if the bank failed, rejected it.

The price of a similar bond by BNP Paribas SA, which has also remained outstanding over four decades, jumped 1.5 cent on the dollar to about 94 cents after the DNB announcement, based on data compiled by Bloomberg.

(Updates with analyst comment in fifth paragraph, bond move in eighth.)