Insurers in India are lining up to grab a share of the nation’s debut 50-year bond offering, highlighting the growing heft of long-term investors in the nation’s $1 trillion debt market.

The government plans to sell 100 billion rupees ($1.2 billion) of a 2073 bond on Friday, according to the Reserve Bank of India. Bajaj Allianz Life Insurance Co. Ltd. and HDFC Life Insurance Co. Ltd. anticipate demand for the paper will be strong as insurers try to lock in higher yields to take care of long-term commitments.

“All of us would want to buy some of those 50-year bonds to cover the asset-liability mismatch,” said Sampath Reddy, chief investment officer at Bajaj Allianz. The long bond “will help us manage interest rate risks better for our portfolios.”

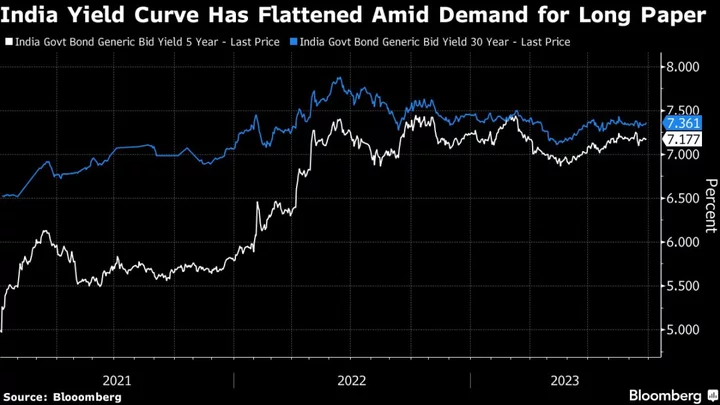

The nation’s thriving life insurance and pension fund industries, driven by an expanding middle class, are changing the landscape for India’s sovereign debt market. India’s yield curve has been nearly flat even amid record borrowing by the government as insurers stepped up purchases of long-term bonds.

The yield on the 50-year note is likely to be close to its 40-year counterpart, which was sold at about 7.54% last week, according to HDFC Life and and Kotak Mahindra Life Insurance Ltd. Indian authorities may be trying to increase the tenure of debt sold and expect yields to decline once India’s sovereign bonds get included to JPMorgan Chase & Co.’s emerging market index next year.

Over one-third of the government’s fiscal second-half bond supply is in papers maturing in 30-50 years. The Reserve Bank of India said last month it plans to add the 50-year bond in response to market demand for ultra-long papers, extending the nation’s yield curve.

Insurers’ holdings of government bonds rose to 26% at the end of March 2022, up from over 23% in 2018, according to the latest finance ministry data, reflecting their growing heft in the local debt market. Bank’s ownership fell to 38% from 43% in the period.

Even as the government is borrowing a record 15.43 trillion rupees of bonds in the current fiscal year, bonds in India have been relatively less volatile compared to their US counterparts, partly due to higher demand from insurers and pension companies.

The yield on a benchmark 10-year bond has risen just four basis points this year, while that on a similar-maturity US note has climbed nearly 100 basis points.

The longer-dated bonds, like 30- and 40-year papers, have been the most well-received segment in the whole yield curve in the auctions so far, said Badrish Kulhalli, head of fixed-income at HDFC Life.

“The key buyers over here definitely are insurance companies because the way we look to buy government securities is to try and match tenure of our liabilities with tenure of assets,” he said.