Crypto fans are now paying a price for Bitcoin’s weakened correlation with technology stocks.

The top digital asset posted a monthly slump in May for the first time in 2023, while the Nasdaq 100 added almost 8% amid hype over artificial intelligence.

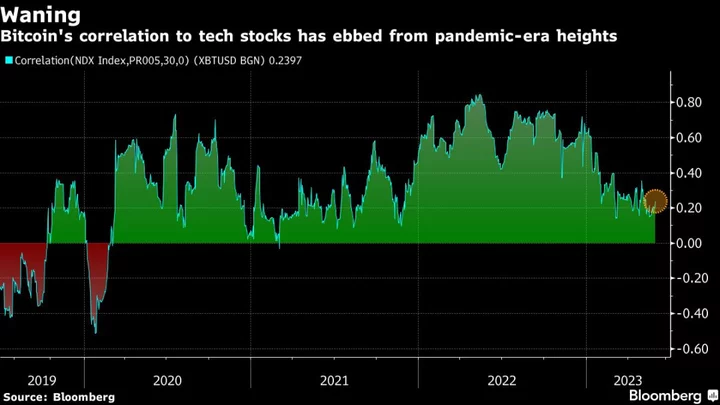

A 30-day correlation coefficient for Bitcoin and the tech-heavy Nasdaq 100 is around 0.2 versus 0.8 in May 2022. A reading of 1 indicates assets are moving in lockstep, while minus-1 would show they’re moving in opposite directions.

Digital-asset investors delighted in crypto’s waning tie with shares earlier in the year when tokens were surging and leaving equities behind. The implications of the split are less favorable now.

“A bit of idiosyncratic risk has finally returned to these assets as opposed to just everything is the same,” said Peter van Dooijeweert, head of multi-asset solutions at Man Group. The Nasdaq is being aided by the AI buzz, he added.

Bitcoin’s rebound this year has fizzled to 64% after last month’s near 8% drop. The token slid more than 1% to $26,734 as of 10:51 a.m. in Singapore on Thursday. Smaller coins like Ether and XRP were also on the back foot.

Read more: Bitcoin’s Wait-and-See Mode Puts Volatility at Lowest Since 2020

Back in the pandemic era of huge stimulus both crypto and tech stocks surged in tandem. Correlations between tokens and a variety of traditional assets have since weakened in the wake of a 2022 crash in virtual coins that ended up diminishing investor interest in the market.

‘Dynamic’ Correlations

“Correlations have and will continue to be dynamic in the space as adoption grows and changing investment theses dominate trading windows,” said Stephane Ouellette, chief executive of FRNT Financial Inc., an institutional platform focused on digital assets.

The Nasdaq 100 has jumped 30% this year and some analysts question how sustainable the gains are given that a handful of mega-cap names have helped to propel the rally.

Over the long term, decoupling from the Nasdaq and the big mega-cap tech shares could potentially be a benefit for digital assets, according to Alex Coffey, TD Ameritrade senior trading strategist.

For now the AI hype may continue to split crypto and tech shares.

In part because of the AI narrative, there is “room for the Nasdaq to outperform the major cryptocurrencies, as Bitcoin and Ether have been trading range-bound with low implied volatility and weak spot demand,” said Chris Newhouse, an independent crypto derivatives trader.