Ether-futures ETFs could be coming to the US soon, but the cryptocurrency market doesn’t seem to care.

Eight companies — including Bitwise, Volatility Shares and ProShares — have in recent days filed applications for exchange-traded funds based on futures for the second-largest digital token, according to a Bloomberg Intelligence tally. Some of the filings even propose to list more exotic versions of the product, such as Bitcoin-Ether-futures medleys.

On Tuesday, Volatility Shares said it was targeting Oct. 12 as a potential launch date for its Ether Strategy ETF, which would trade under the ticker ETHU. Many ETFs can launch 75 days after their initial filing date, unless the fund fails to meet the US Securities and Exchange Commission’s requirements. The SEC didn’t respond to a request for comment.

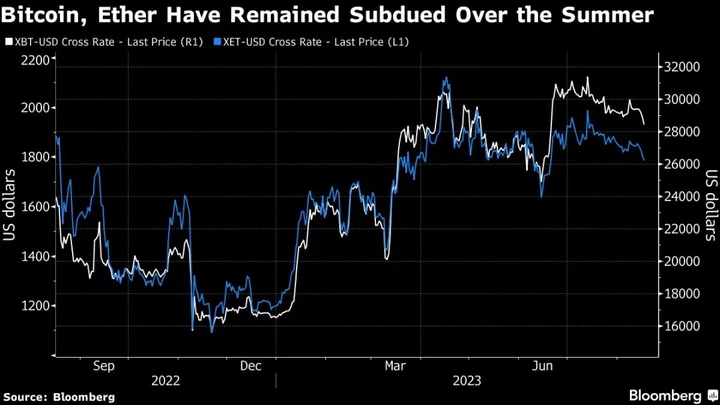

But the crypto market hasn’t seemed to notice the slew of filings. Bitcoin has been hovering around $29,000 for most of July and August, and Ether — at $1,740 — is lower by about 6% since the start of the month. Both tokens, which combined account for about 65% of the $1.15 trillion crypto market’s value, are trading at less than half their all-time highs. Bitcoin on Thursday fell to a two-month low of around $28,000.

“Outside of our little weird reality tunnel in the financial world, you don’t hear people out in the wild — that aren’t extremely online on Twitter watching tickers all day, every day — talking about these things any longer,” said Ben Johnson, head of client solutions at Morningstar Inc. “The moment has come and gone with respect to mass interest, mass adoption.”

The filings are part of a wave of appeals submitted with the SEC in recent weeks, all coming in the wake of BlackRock Inc.’s surprising application for the first Bitcoin spot ETF. The June submission gave a roughly 20% boost to the price of Bitcoin in the following two weeks.

Yet instead of favoring crypto products, investors right now might be gravitating more toward ETFs centered around stocks, for instance, said Todd Rosenbluth, head of research at ETF data-provider and research consultant VettaFi.

“There isn’t as much hype for things for crypto ETFs,” he said. “They are a niche product mostly likely used by speculative investors.”

The first Bitcoin-futures funds in the US launched in October 2021 and were a hit right from the start. The ProShares Bitcoin Strategy ETF (BITO), the first to premiere, amassed $1 billion in assets at a lightning-fast pace. But the fund wasn’t able to sustain that momentum, and flows slowed over time.

Crypto-based products have failed to generate much investor interest even with them being the best-performing equities ETFs this year. Nine of the 10 top-performers are crypto-related, according to Bloomberg data. The top five are all higher by more than 100% in 2023. But the nine have collectively only gathered around $40 million in inflows this year, Bloomberg data show.

“The hype just isn’t there,” said James Seyffart, an analyst at Bloomberg Intelligence.

Investors might be remembering the Bitcoin-futures launches, which debuted mere weeks before Bitcoin hit its all-time high of almost $69,000 in November 2021, said BI’s Seyffart. Ether reached $4,866 the same month.

It “feels a little less exciting compared to the Bitcoin-futures ETF launches because they were the first and they launched at the height of a crypto bull market,” he said. “That said, we are still months away from a potential launch and interest and excitement is likely to pick up when more people realize these are likely to launch,” he said of the Ether-futures funds.

Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, says that there hasn’t been much impact on the prices of Bitcoin and Ether, even as the odds of both spot-Bitcoin and Ether-futures fund approvals rise.

“US market-observers may be getting excited about the potential, but it looks like investors aren’t — not yet anyway,” she said. “This is weird, since there are likely to be strong inflows should approval materialize — in other words, there is significant upside. But it doesn’t feel like either is priced in yet, a further example of just how inactive markets are.”

--With assistance from Lydia Beyoud.