Crypto traders are turning increasingly bearish on the BNB token that serves as the centerpiece of the embattled Binance digital-asset trading platform.

The negative sentiment is most reflected on the perpetual swap market, a type of futures contract used in crypto markets that do not expire. Data from Coinglass shows that the open interest-weighted funding rate turned negative this weekend, meaning that speculators betting on a price decline are willing to pay those counting on gains to keep their bearish positions on BNB open.

“Typically, negative funding rates indicate heavy short positioning. In this case, it seems traders are betting on a decline in BNB prices,” said Darius Tabatabai, co-founder of decentralized exchange Vertex Protocol. “For now, headlines seem to be fairly neutral but it will be interesting to see how this plays out.“

Regulatory crackdowns on Binance from Australia to Europe and the US are becoming a drag on the business of the world’s biggest crypto exchange. The heightened scrutiny has also prompted some banking partners to drop Binance, limiting clients’ ability to deposit and withdraw fiat money on the exchange.

Shiliang Tang, chief investment officer at crypto investment firm LedgerPrime said that the trade seems like a “very short-term bet,” since speculators are paying a steep fee to keep positions open. Also contributed to the negative funding rate is the lack of arbitragers to keep long positions on BNB in the perpetual swap market.

“There’s no real way to borrow spot BNB,” Tang observed, pointing out that it’s very hard to short BNB on the spot market due to lack of liquidity.

Open interest of BNB perpetual swaps grew in the past few days to $460 million, according to Coinglass.

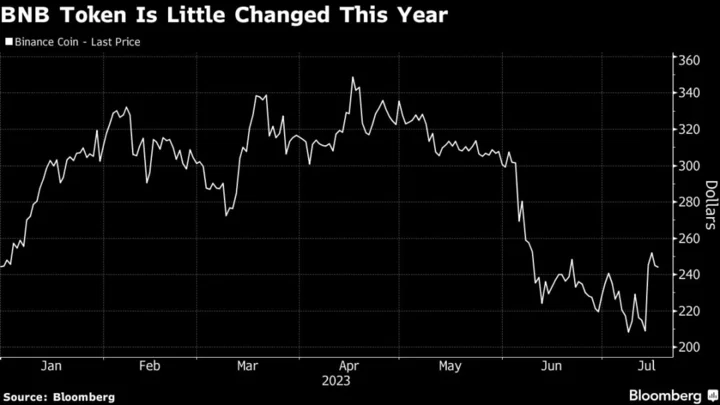

BNB, the fifth-largest cryptocurrency by market value, fell less than 1% to around $243 as of 1:23 p.m. in New York. The token is little changed this year, whereas an index of the largest 100 coins has rallied around 50%, data compiled by Bloomberg shows.

BNB is the native token of both Binance and Binance-initiated blockchain BNB Chain. The funding rate of BNB turned negative during recent times of turmoil, such as when the US Securities and Exchange Commission filed a lawsuit in June against Binance Holdings Ltd., Binance.US and Changpeng “CZ” Zhao, the founder and owner of the exchanges. Zhao and the companies have disputed the SEC’s allegations.

“Last time the OI spiked this much, the SEC news came out so maybe indicative,” Tang said. “But if nothing comes out in a week or so, maybe OI and rates see some relief.”