Country Garden Holdings Co. is seeking to extend a maturing bond for the first time ever and halted trading in local notes, as a crisis at what was once China’s biggest developer spreads unease in the nation’s financial markets.

The builder, whose woes threaten even worse impact than defaulted peer China Evergrande Group given it has four times as many projects, is soliciting feedback on a proposal to extend payment of a 3.9 billion yuan ($537 million) note due Sept. 2, people familiar with the matter said. It also suspended trading of 11 onshore notes issued by the company and subsidiaries, according to filings.

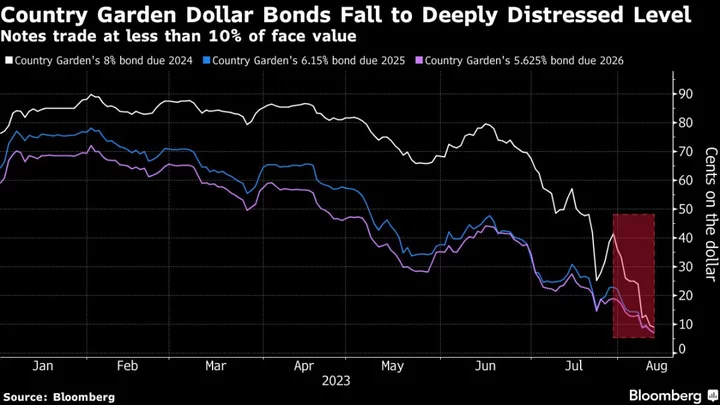

Shares in Country Garden, helmed by one of China’s richest women, Yang Huiyan, fell 18.4% to close below HK$1, after breaching that level for the first time ever last week. Its bonds have fallen deep into distress, indicated below 10 cents. In a sign of the wider impact, Chinese dollar junk bonds extended declines by 2 cents, after falling to their lowest level this year last week at about 66 cents. A Bloomberg Intelligence gauge of builders declined 3%.

“We see higher risk of contagion not only across the sector but also possible spillover to the wider economy,” JPMorgan Chase & Co. analysts including Soo Chong Lim wrote in a research note.

The worsening situation at Country Garden is unnerving markets given its sheer size. It comes just as turmoil at Zhongzhi Enterprise Group Co., a secretive financial conglomerate that manages about 1 trillion yuan and is one of China’s largest private wealth managers, triggers anxiety about the shadow banking industry after missing payments on multiple high-yield investment products.

It also underscores the challenges China faces in containing a property debt crisis that’s sparked record defaults, homebuyer protests and fresh concerns about trust firms with exposure to real estate projects. Despite being among the first firms selected last year for a program to help developers raise fresh financing via state guarantees on local bond sales, Country Garden has still stumbled.

Country Garden has yet to default on public bonds, but the clock is ticking on a 30-day grace period after it missed coupon payments effectively due Aug. 7 on two dollar notes.

The stakes are immense. The builder of more than 3,000 housing projects in smaller cities is a household name and employed about 70,000 people at the end of last year.

It had 1.4 trillion yuan of total liabilities at the end of last year. To put that figure in perspective, it exceeds the annual economic output of a long list of countries including Kuwait. The wider pain in China’s property market, where sales have started to fall anew, is making it harder to manage that mountain of debt.

Country Garden said last week it would report a net loss of 45 billion to 55 billion yuan in the first half of this year, compared with earnings of 1.91 billion yuan in the same period of 2022.

The builder is proposing to extend the yuan bond with amortized disbursements over 36 months, according to the people, who asked not to be identified discussing a private matter. Country Garden didn’t comment when reached Monday.

Click here for more details on the plan

The news comes after other people said last week that the builder was considering extending some soon-to-mature securities. Some representatives of bank China International Capital Corp. told some noteholders that its bond-underwriting team had been engaged to explore options for yuan-note maturities, they said.

Country Garden’s credit stress “is likely to spill over to the country’s property and financial markets,” Moody’s Investors Services analysts including Kai Yin Tsang wrote in a research note. “Specifically, it is likely to further weaken market sentiment and delay the recovery of China’s property sector.”

In a separate statement Saturday, the company said it’s planning to hold meetings with bondholders on the repayment arrangements in the near future. It reiterated it will take measures to defuse risks and protect the legitimate rights of its investors while ensuring home deliveries.

“Considering its large exposure in low-tier cities, we believe it could take years for Country Garden to recover from its liquidity challenges,” Morgan Stanley analysts including Stephen Cheung wrote in a note, as they cut the price target on the shares.

In the bond suspension notice, the company said it would “consider adopting various debt management measures” to safeguard its long-term development in the future.

Here’s a calendar of Country Garden’s upcoming bond principal and interest payments across currencies through September:

--With assistance from Emma Dong and Jacob Gu.