Colombia held interest rates at a 24-year high as policymakers fret that inflation is taking too long to slow to its target.

The central bank left its benchmark rate at 13.25%, Governor Leonardo Villar told reporters on Tuesday. The decision was in line with expectations.

Five of the seven-member board backed the decision, while two voted for a cut of a quarter percentage point.

“The majority of the board considers that, based on the available information, it still isn’t opportune to start a process of interest rate reduction, and that it is appropriate to wait for conditions that give greater confidence about the sustainability of this process,” the bank said in its statement.

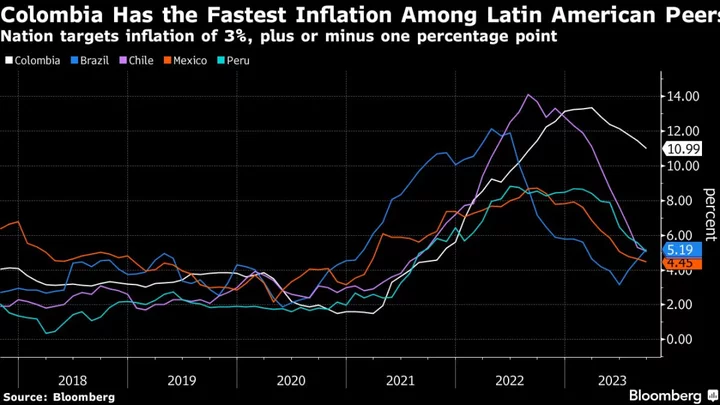

Colombia and Mexico are the only major inflation-targeting economies in Latin America that haven’t yet started to cut interest rates. Brazil, Chile and Peru, as well as smaller economies such as Costa Rica, Uruguay, Paraguay, and the Dominican Republic, are all easing monetary policy as inflationary pressure cools after the post-pandemic price spike.

Colombian inflation hasn’t slowed as fast as policymakers expected, and is the highest among regional peers. Annual price rises slowed for a sixth straight month in September, to 11%, though that’s still far above the upper bound of the 2% to 4% target range.

Economists surveyed by the bank forecast that it will take another two years for inflation to return to its target range.

Harvest Fears

Policymakers fear that droughts caused by the El Nino weather phenomenon could hit harvests, causing a rise in food prices. Dry weather may also cause a spike in energy costs in a country that gets most of its electricity from hydroelectric dams.

Read more: Central Banker Sees Risks for Colombia in Cutting Rates Too Soon

Colombia will start cutting interest rates in December, according to economists surveyed by the central bank before today’s decision.

The bank forecasts economic growth of 0.9% this year, though the estimate is likely to be revised in the monetary policy report that will be published on Thursday.

In recent months, President Gustavo Petro and Finance Minister Ricardo Bonilla have repeatedly called for the bank to start cutting borrowing costs, to prevent a sharp slowdown.

--With assistance from Rafael Gayol.

(Updates with vote breakdown in second paragraph.)