Tapestry Inc., with Coach, and Capri Holdings Ltd., with Michael Kors, have been battling for nearly a decade to dominate the US handbag market. On Thursday, Tapestry sealed its victory — and now the shopworn Michael Kors brand becomes its problem to solve.

Tapestry’s $8.5 billion acquisition of Capri caps a yearslong strategy at Coach: Keep exposure to department stores low, invest in sprucing up stores and launch chic but classic handbags. Then, roll out updated versions of those popular styles while steadily raising prices and the brand’s cachet. That’s a strategy that Michael Kors hasn’t been able to match.

“The numbers for Kors haven’t been great for some time,” Jessica Ramirez, an analyst at Jane Hali & Associates, said in an interview.

Coach said in Tapestry’s most recent quarterly earnings report that it plans to continue to increase the average price of its products even as some US consumers pull back on spending. Michael Kors executives, meanwhile, have said they will pause price hikes after shoppers started to revolt. “I haven’t heard that from anyone else,” Ramirez said.

While Michael Kors raised the average prices of its handbags in several quarters during the pandemic, much of that was because it was able to cut back on sales and other discounts and sell its purses at full price, amid unprecedented demand for high-end accessories in the US. But as those tailwinds have begun to fade, parent company Capri has had to resort once again to greater discounting to boost revenue.

A typical Coach handbag, for example, sold for $498 before Covid-19 and, with pandemic price hikes, now goes for around $598, Ramirez estimated. Meanwhile, a typical Michael Kors handbag is listed at $398 but is usually on sale — and the designs are a bit stale, she added.

“It’s the same bag over and over, season after season, and the only thing that really changes is the color and maybe some detailing,” Ramirez said, pointing to the brand’s Parker handbag line as a case in point.

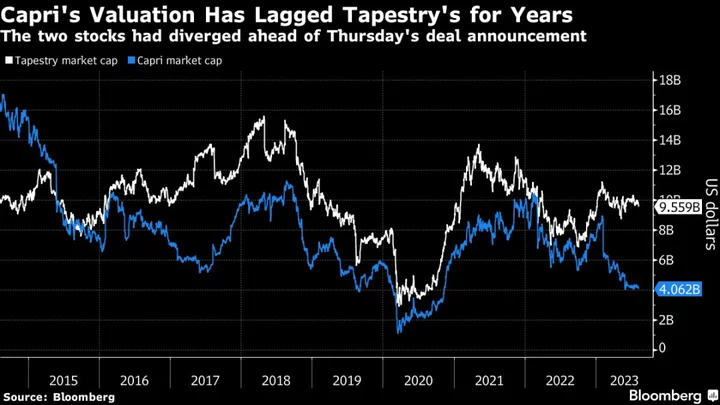

The divergence is showing up in investors’ judgments on the companies. As recently as March 2022, Tapestry and Capri each had a market capitalization just above $10 billion. But while Tapestry managed to hang in close to that level through Wednesday, Capri’s value had plunged to just $4.1 billion over the same period.

Capri said Thursday after the market close that revenue in the most recent quarter fell 9.6% versus last year. The decline at the Michael Kors brand was even sharper, which means the business is smaller than it was before the pandemic began.

“Given that the market has boomed over this period,” GlobalData analyst Neil Saunders wrote, “this is little short of an abysmal performance which marks the company out as one of the weakest players in the luxury space.” Tapestry reports earnings Aug. 17.

Handbag Wars

About a decade ago, Coach and Michael Kors battled it out against each other — and whimsical handbag company Kate Spade — driving down prices to win more US market share in a vicious cycle that was dubbed the handbag wars. As a detente settled in, all three companies tried to revive their brands.

For Coach, the turning point was when the brand hired former Loewe designer Stuart Vevers as creative director in 2013, said Oliver Chen, an analyst with TD Cowen. “He shocked the brand and re-energized it,” Chen said in an interview. Vevers rolled out the Rogue bag, for example, and the Tabby line, which the 49-year-old has repeatedly released in different iterations.

Michael Kors, by contrast, never had that same designer reset to revitalize and elevate its positioning. Michael Kors, 64, still leads design at his namesake brand, which he founded in 1981.

Also, for about a decade, Coach has maintained its revenue from department stores — known in the business as wholesale — at around 10% of sales. That compares with more than a third of revenue from wholesale at Michael Kors’ parent company. While the channel remains important for many brands, over-reliance can mean they lose out on controlling their image and the data that comes along with sales. “The path to greatness is direct-to-consumer” sales, Chen said.

Tapestry has also developed a top-notch customer-data platform that lets the Coach parent more effectively personalize marketing materials for shoppers, Chen added. The system also improves inventory management by making sure the right items get to the right place at the right time.

“It’s what every single retail company on earth needs,” Chen said. “It’s not easy to build.”

US Leader

Coach has also won the ongoing battle against Michael Kors to build the largest US-based platform for high-end brands, in an attempt to emulate the financial and marketing successes of European luxury conglomerates LVMH and Kering. Coach snapped up shoemaker Stuart Weitzman and Kate Spade and grouped the three brands under the Tapestry name. Meanwhile, Michael Kors bought footwear marque Jimmy Choo and, more recently, Italian luxury house Versace, uniting them under the Capri umbrella.

Longtime Capri Chief Executive Officer John Idol has said in recent years that he was keen on more acquisitions as he continued to build a formidable US-based luxury house. But, in the end, Tapestry CEO Joanne Crevoiserat beat him to the punch by acquiring Idol’s company instead.

Crevoiserat and her team have their own battles ahead, though, including to continue to turn around the brands they already own — Kate Spade and Stuart Weitzman.

“Stuart Weitzman is a mess,” Morningstar analyst David Swartz said in an interview. Sales at the brand have been sluggish. Kate Spade, meanwhile, is unlikely to “ever be a market leader,” Swartz added.

If the deal closes as expected in 2024, Tapestry will then have its hands full to turn around Michael Kors as well as Versace and Jimmy Choo. The latter two haven’t been “consistently profitable since Capri bought them,” Swartz said.

Investors have always had high hopes pinned to Versace. While Capri made it more profitable by selling more handbags and other accessories, it’s still a work in progress. “This is a company everybody has heard of,” Swartz said. “Yet its sales are one-tenth of some of the bigger luxury companies out there like Chanel and Gucci.”

Meanwhile, competitors are watching to gauge the eventual success of the deal. In an interview after his company’s earnings report Thursday, Ralph Lauren Corp. CEO Patrice Louvet observed: “As with anything — and especially in our sector — it’s ultimately all about execution.”