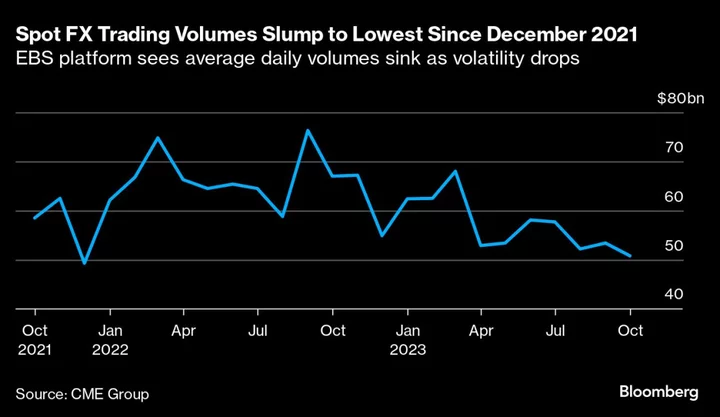

Currency volumes have dried up to the lowest in two years as quiet markets give investors little reason to trade, according to data from CME Group, the largest FX venue.

An average of $50.8 billion changed hands each day on CME’s spot platform, known as EBS, last month. That’s also the third-lowest reading since it started reporting activity in 2017, and compares with about $75 billion in early 2021.

Foreign exchange markets have been rangebound, with the Bloomberg Dollar Index moving within a 2% band in October, amid signs that the Federal Reserve plans to hold interest rates steady after an aggressive run of monetary tightening. An index tracking one-month implied volatility between major currency pairs is near the lowest since February 2022.

Read More: Corporate Giants Are the New Hedge Funds of the Global FX Market

EBS and Refinitiv have been the largest interbank trading venues for spot foreign-exchange for the last three decades. While the two brokers are still the main reference point for prices, they’ve been facing competition from newer market entrants in recent years, according to the Bank for International Settlements.