(Bloomberg) --

Clean energy funds are in the dirt.

They’ve slumped roughly 30% this year after losing almost 5% of their value in 2022 and a whopping 23% in 2021. The renewables industry has been battered by rising interest rates, which have been especially damaging for new solar projects, and disappointing earnings, caused largely by higher capital costs and lower profit margins.

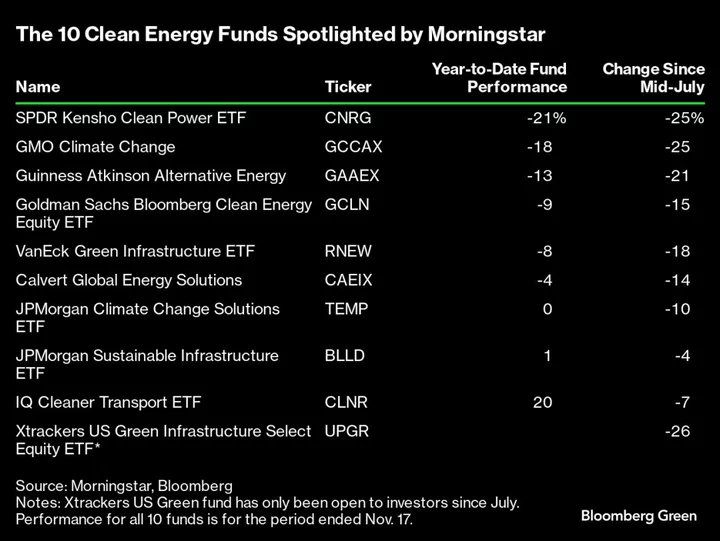

Morningstar Inc., however, says there are better times ahead. Analysts there say they’ve identified 10 climate funds where the long-term outlook is “bright.” They base their conclusions on an analysis of funds they consider highly rated, focus on clean energy themes and are successful at “delivering positive climate impact.”

Four of the 10 funds don’t have much of a track record since they’ve only been open since early 2022. And many of the funds are very small, like the $1.7 million VanEck Green Infrastructure exchange-traded fund (ticker RNEW) and the $4.2 million Xtrackers US Green Infrastructure Select Equity ETF (UPGR).

Still, two have Morningstar’s highest gold medal rating: the $147 million Calvert Global Energy Solutions (CAEIX) and the $24 million JPMorgan Sustainable Infrastructure ETF (BLLD).

Growth prospects for renewable energy will be a central plank of discussions when world leaders start gathering next week in Dubai for COP28.

Read More: US, EU Lead Push for COP28 to Back Tripling of Renewables

“All the funds are targeting either the energy transition or a clean energy-tech theme,” said Alyssa Stankiewicz, an associate director in Morningstar’s sustainability research group. “That means they tend to be concentrated in companies that are key to producing and distributing renewable energy, everything from solar providers like Sunrun to electric utility companies like Iberdrola.”

All 10 of the funds spotlighted by Morningstar are “pure plays” when it comes to investing in clean energy and the energy transition. That means they’re almost completely dependent on this part of the market doing well.

But the opposite has been the case since the start of 2021. For example, in slightly less than three years, the S&P Global Clean Energy Index, including reinvested dividends, has plummeted 48%.

The Calvert fund stands atop Morningstar’s recommended list. It invests the bulk of its assets in solar, wind, biomass, geothermal and hydropower. Infratil ITF of New Zealand is one of its top picks—the company generates more than two thirds of its revenue from wind turbines and hydropower plants.

The $11 million Goldman Sachs Bloomberg Clean Energy Equity ETF (GCLN) holds roughly 200 stocks, but more than one third of its assets are in the fund’s 10 biggest holdings, led by Iberdrola SA and Tesla Inc. By contrast, the $26 million Guinness Atkinson Alternative Energy (GAAEX) has roughly half of its assets invested in just 10 stocks.

Meanwhile Trane Technologies Plc, a maker of residential HVAC systems and refrigeration solutions, ranks as the Guinness Atkinson fund’s top holding. Morningstar pointed to a report from the International Energy Agency which says cooling is the fastest-growing use of energy in buildings, and improving energy efficiency is one of Trane’s main businesses.

The $5.9 million IQ Cleaner Transport ETF (CLNR) has been the best performer on the list this year (as of the end of last week), rising 20% thanks in large part to Intel Corp. and Toyota Motor Corp.

At the other end of the spectrum among Morningstar’s selections is the $232 million SPDR Kensho Clean Power ETF (CNRG), which dropped 21% in the same period, dragged down by stakes in companies including Brazil’s Centrais Eletricas Brasileiras SA (better known as Electrobras).

In the end, Morningstar acknowledges that investing in clean energy on its own is a risky strategy and any holdings should be part of a broader, more diversified portfolio mix.

The clean energy sector has suffered large market swings and will almost certainly continue to do so. As Morningstar notes, it’s definitely not for the “the faint of heart.”

Will selloff in green stocks continue next year? Share your views in Bloomberg’s MLIV Pulse survey .

Sustainable finance in brief

Most people paying attention to environmental, social and governance investing know the sector is bobbing if not fully drowning in an ocean of greenwashing. Now, there are more numbers to ruin your day. A majority of net-zero pledges are being directly undermined by the lobbying activities of the companies making them. InfluenceMap, a London-based nonprofit, found that 58% of the companies it analyzed advocate on climate policy in a way that’s at odds with their supposed net-zero goals. The research, which looked at almost 300 companies in the Forbes 2000, said the findings point to—wait for it—the prevalence of “net-zero greenwash.” Catherine McKenna, a former Canadian environment minister, says “not only are many companies choosing to undermine their own climate commitments by lobbying against climate action, their net-zero commitments are simply not credible.”

- On the same topic, Big Oil is touting carbon capture as a get-out-of-climate-crisis-free card. This corporate group calls it a “dangerous delusion.”

- The right-wing attack on ESG on behalf of the fossil fuel industry is winning. US borrowers are retreating en masse from the world’s second-biggest ESG debt class.

- A French rule targeting ESG funds has the potential to force oil and gas divestments of €7 billion ($7.6 billion).

- Several Tesla Inc. shareholders rebuked Chief Executive Officer Elon Musk for endorsing antisemitic views on his social media platform X, with some saying he should be suspended.