By Andrew Chung and John Kruzel

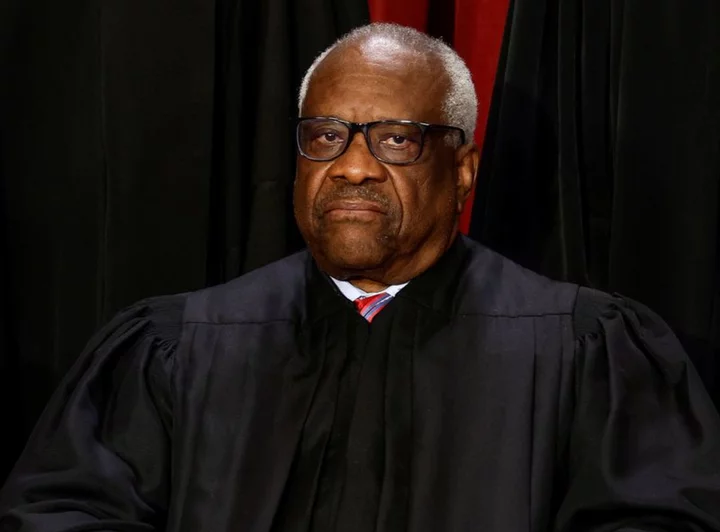

WASHINGTON New findings that U.S. Supreme Court Justice Clarence Thomas apparently failed to repay at least a "significant portion" of a $267,230 loan he received from a wealthy benefactor prompted Senate Democrats on Thursday to step up their criticism of the court's lack of an ethics code.

A personal loan that Thomas received in 1999 from longtime friend Anthony Welters to buy a Prevost Marathon motor coach was forgiven before the principal was fully repaid, according to a report by Senate Democrats on Wednesday based on a review of loan documents provided by Welters.

"With each new report, the American people realize how many lavish, undisclosed gifts Justice Thomas has received from his gaggle of fawning billionaires," Democratic Senate Judiciary Committee Chairman Dick Durbin wrote on Thursday in a social media post.

Durbin said the "undisclosed, forgiven" loan demonstrates the need for a binding code of conduct for the court.

Thomas, part of the court's 6-3 conservative majority, has been a focal point of criticism by Democrats amid revelations this year involving some of the justices concerning hobnobbing with the rich and powerful, private jet trips, luxury vacations and real estate transactions.

The latest matter involving the luxury motor coach was scrutinized by Democrats on the Senate Finance Committee after the New York Times published an article on the loan in August.

The committee released its findings on Wednesday, concluding that none of the documents indicated that Thomas "ever made payments to Welters in excess of the annual interest on the loan." The documents showed that Welters forgave the loan in 2008, according to the findings.

Finance Committee Chair Ron Wyden called on Thomas to explain "exactly how much debt was forgiven" and whether he reported any loan forgiveness on his tax returns and paid all taxes he owed. The findings also noted that Thomas did not report the "forgiven debt" on his 2008 financial disclosure forms, which require the inclusion of any "discharge of indebtedness" as income.

In a statement, Thomas's attorney Elliot Berke said, "The loan was never forgiven. Any suggestion to the contrary is false. The Thomases made all payments to Mr. Welters on a regular basis until the terms of the agreement were satisfied in full." Berke did not answer further questions as to whether the principal of the loan was paid in full.

The Senate Judiciary Committee in July approved a Democratic-backed bill that would mandate a binding ethics code for the justices. Given Republican opposition, the bill has little chance of becoming law.

Thomas and Welters did not immediately respond to requests for comment.

Unlike other members of the federal judiciary, the life-tenured justices have no binding code of conduct, though they are subject to certain financial disclosure laws.

The news outlet ProPublica reported this year on Thomas's failure to disclose luxury trips and real estate transactions involving Texas businessman Harlan Crow.

Thomas previously defended his omission of the Crow-funded luxury trips from his disclosure forms by saying he believed they were "personal hospitality" and thus exempt from disclosure requirements, and called his nondisclosure of the real estate transaction inadvertent.

Steven Lubet, a legal ethics expert who teaches law at Northwestern University, said Thomas's failure to disclose the motor coach loan "is more significant than the past failures."

"There isn't even a plausible excuse this time," Lubet said. "The directions could not be more clear. It's a quarter of a million dollars - it's hard to attribute that to inadvertence."

"Thomas's votes can send someone to prison for life or financially destroy them for breaking the law," added Stephen Gillers, a legal ethics expert who teaches law at New York University. "Yet he repeatedly breaks the law, confident that he is immune to consequences."

(Reporting by Andrew Chung in New York and John Kruzel in Washington; Editing by Will Dunham)