Citigroup Inc. strategists raised US stocks to neutral and tech shares to overweight on the expected boost from artificial intelligence, expected end of the Federal Reserve’s rate hikes and resilient American economic growth compared to China and Europe.

US equities are being powered by the bet on AI because of high exposure to tech mega-caps, strategists on Citi’s global asset allocation team including Dirk Willer said in a note. This theme will help them outperform other stock markets once the Fed completes its tightening cycle.

“While price moves for AI-related stocks have clearly been extreme, especially at a time when monetized-use cases are still in the future, and with barriers to entry not overly high, we would still expect that it is too early to fade the moves before AI has even developed far enough to be able to disappoint expectations,” the strategists said.

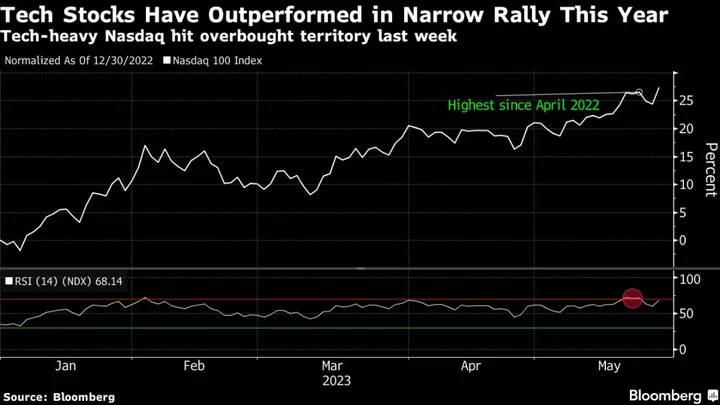

The recovery in US equities this year has been led by a small group of tech giants as investors shifted toward companies with strong earnings potential and exposure to AI. The Nasdaq 100 Index is up 27% in one of the world’s top performances and set for its best start to a year since 1998. On a broader-index basis, Europe’s Stoxx 600 and the S&P 500 are both up around 8%.

Nvidia Corp. on Thursday surged to a record high, approaching $1 trillion market value, on booming demand for its AI processors.

The strategists also cut European equities to underweight and China stocks to neutral, as weaker Chinese growth will hurt the European business cycle. It remains overweight UK stocks due to defensive characteristics and cheap valuations.

Citi strategists cut US stocks to an underweight in early December, while lifting European shares to neutral. In Friday’s note, they explained that they had been underweight US equities because of recession fears, as stocks typically bottom during a recession and not before. But Citi economists now see a US recession starting only in the fourth quarter, with risks for this to be pushed further out.

“We must admit that the long-awaited recession is still not overly close and the expected credit crunch — fallout from the March banking turmoil — has also so far not materialized in a significant form,” the Citi strategists wrote.