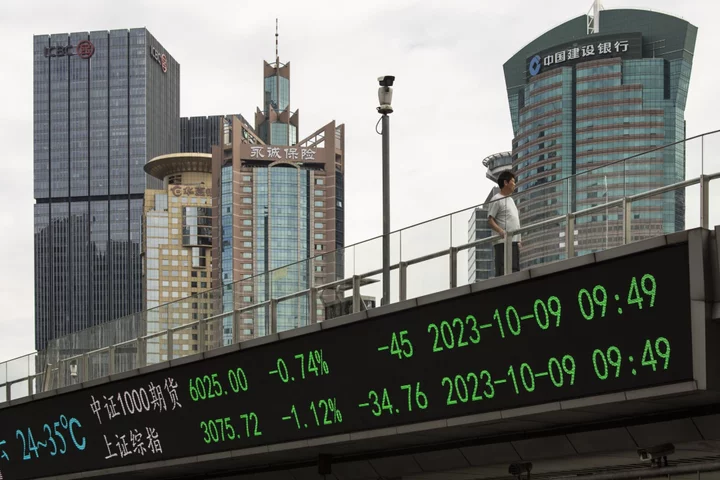

Chinese stocks are poised for gains after US-listed shares of mainland companies recorded their biggest one-day jump since July, spurred by rare fiscal measures from Beijing and President Xi Jinping’s stepped up support for the world’s second-biggest economy.

The Nasdaq Golden Dragon China Index climbed nearly 4%, with Bilibili Inc. leading gains among the major technology names. KE Holdings Inc., a platform that facilitates housing transactions, rallied the most in two weeks, and electric-vehicle maker XPeng Inc. jumped more than 10%. FTSE China A50 futures and contracts for Hong Kong’s benchmark Hang Seng Index also joined the rally.

The nation’s legislature approved a plan to raise the fiscal deficit ratio for 2023 to about 3.8% of gross domestic product, the official Xinhua News Agency said Tuesday — well above the 3% set in March which the government has generally considered a limit for the nation. The plan includes issuing additional sovereign debt worth 1 trillion yuan ($137 billion) in the fourth quarter to support disaster relief and construction.

First PBOC visit

China has rarely adjusted the budget mid-year, having previously done so in periods including 2008, in the aftermath of the Sichuan earthquake and in the wake of the Asian financial crisis in the late 1990s.

“This suggests Beijing may not be complacent with recent growth stabilization,” Nomura Holdings Inc. economists led by Lu Ting wrote in a note. China may be willing to add more debt, especially on-budget government debt, as local governments’ off-budget borrowings have become increasingly unsustainable, he added.

The moves “should give the stock market a confidence boost as it sends a proactive fiscal signal,” according to Ming Ming, chief economist at Citic Securities Co.

In a surprising move also aimed at shoring up the economy and financial markets, Xi, along with vice premier He Lifeng and other government officials, made his first known visit to the People’s Bank of China since he became president a decade ago, Bloomberg News reported.

“With a rare mid-year budget expansion when growth is on track to reach the target, and an equally rare visit to the PBOC by the top leaders, policymakers are sending a strong signal of their intent to reflate the economy with coordinated monetary and fiscal easing,” wrote Morgan Stanley economists led by Robin Xing in a note. “This is more positive than we had expected, and another step toward reflating the economy.”

For economists Lisheng Wang and Maggie Wei at Goldman Sachs Group Inc., “top policymakers demonstrated their focus on the economy and financial market via various gestures today, which may help restore confidence to some degree.”

READ MORE: Why Global Investors Are Unloading China Stocks: QuickTake

Neo Wang, Evercore ISI’s New York-based managing director for China research, predicts a mild bounce on Wednesday. “Beijing simply cannot afford to see indexes breaking critical support levels and resulting in a heavy blow to investors and consumers’ confidence and their willingness to spend.”

The latest policies are part of pragmatic steps taken since July to restore confidence among entrepreneurs and consumers, Andy Rothman, investment strategist at Matthews Asia, said in an email.

“Still, the process will be slower than what investors would like, and the pessimistic narrative about China’s domestic equity market may not reverse until well into next year,” he said.

--With assistance from April Ma.

(Adds comments from Nomura and Citic Securities in fifth and sixth paragraphs)