Shares of China’s Hua Hong Semiconductor Ltd. jumped in its trading debut in Shanghai after it raised 21.2 billion yuan ($2.96 billion) in the largest sale of new equity in the Asia Pacific region this year.

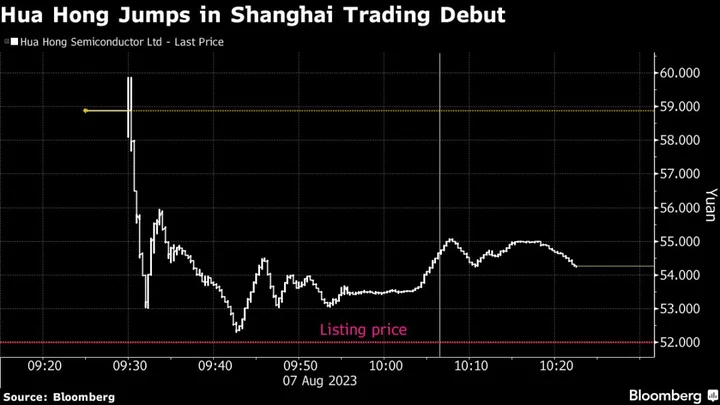

The stock rose as high as 15% in early trade before paring gains. The firm sold 408 million shares, or 24% of its total share capital, at 52 yuan each. Half of the offering was alloted to 30 strategic investors, with the rest distributed among funds and individuals. The company’s Hong Kong-listed shares fell as much as 7.6%.

Hua Hong joins a slew of semiconductor firms to have debuted in mainland China this year. Giving the companies access to public markets is in sync with Beijing’s plans to support the industry in a bid to counter a US-led campaign to block access to cutting-edge technologies. The US has blacklisted Chinese companies and research institutes in diverse fields from chips and supercomputing to cloud and data mining.

“Hua Hong’s A-share IPO price of 52 yuan implies a forward 7.4x EV/Ebitda valuation, and expectations for 25% average annual profit growth over the next three years,” Charles Shum, a technology analyst at Bloomberg Intelligence, wrote in a note Monday. “Still, hurdles to more sustainable earnings gains lurk in the underbrush, including difficulty improving new products’ output yields and escalating local competition.”

Hua Hong’s listing on Shanghai’s Star board follows a 2014 initial public offering in Hong Kong, where it raised about HK$2.6 billion. The company makes semiconductors on 200mm wafers for specialty applications, providing products for consumer electronics, communications and computing.

Meanwhile, China’s domestic market for IPOs, the world’s busiest since last year, has been showing signs of cooling. Proceeds raised in exchanges in Shenzhen, Shanghai and Beijing have been declining since March amid concerns about the country’s economic growth.

READ: Chinese IPOs Seen Cooling as Beijing Eyes Liquidity: ECM Watch