Chinese firms are lining up to invest in South Korea’s battery industry because they want to use it as a gateway to the US market, undermining the Biden administration’s efforts to limit China’s involvement in the electric car supply chain.

Over the past four months, Chinese companies and their Korean partners have announced some 5.1 trillion won ($4 billion) of investments in five new battery factories in Korea. And at least one local government is in talks for more projects, officials from the Saemangeum Development and Investment Agency say.

The Chinese — and Korean — firms are looking to take advantage of Korea’s free-trade agreement with the US, considering batteries made in South Korea and then installed in US-made electric cars will likely qualify for tax breaks under President Joe Biden’s Inflation Reduction Act.

Ningbo Ronbay New Energy Technology Co. announced last week that it had been approved to set up a factory in Korea that will eventually produce 80,000 tons of ternary precursors, an ingredient from which a cathode is formed, a year.

“The product produced by the company’s Korea base meet the relevant requirements for qualified key minerals in the IRA bill and can enjoy the benefit of tariff policies when exporting to European and US markets,” Ronbay New Energy said.

You Sang-yul, head of Ronbay’s Korean branch, said separately in an interview that “South Korea has a lot of talent and knowledge about batteries. Choosing Korea is part of our global strategy because of the IRA.”

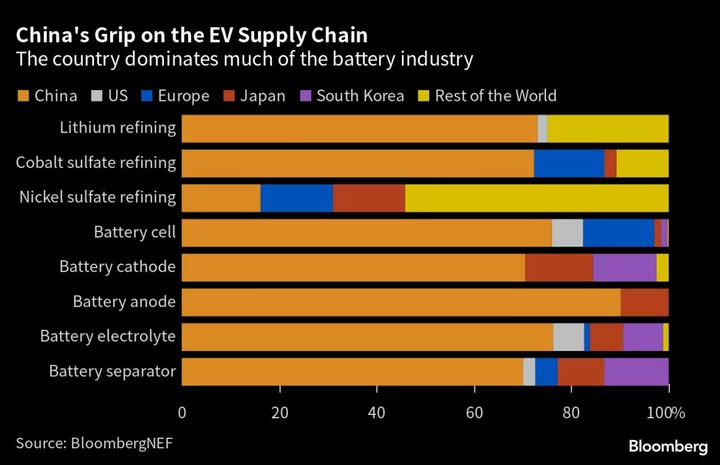

Chinese firms dominate the global battery and battery-materials supply chain, churning out cathodes, anodes and precursors for Korea’s three main EV cell manufacturers — LG Energy Solution Ltd., Samsung SDI Co., and SK On Co. The trio then supply electric vehicle makers like General Motors Co., Tesla Inc. and Volkswagen AG.

The Biden administration wants to reduce US dependence on Chinese companies in its supply chain, but their deep entrenchment will make it difficult and carmakers are lobbying the US government to be lenient in allowing some Chinese-produced parts to be included.

The administration is currently drafting rules that would govern how much content to allow from any ‘foreign entity of concern.’ That’s government-speak for businesses or groups owned or controlled by geopolitical foes of the US. like China and Russia.

“We will continue to assess and respond to any national security concerns associated with both international and domestic supply chains,” said Ashley Schapitl, a spokeswoman for the Treasury.

“China and South Korea, we need each other,” said Lee Myung-kyu, an official at the Korea Battery Industry Association in Seoul. “Korean cell makers feel it’s risky to import battery materials like cathodes and precursors from China due to the IRA. If those raw materials are all made in South Korea, that means Korea will have a more stable supply chain in the country.”

In addition to Ronbay New Energy, SK On announced a joint venture with a Chinese firm in March to build a precursor factory, while Zhejiang Huayou Cobalt Co. agreed to joint ventures with a chemical subsidiary of LG Group and Posco Future M Co. earlier this year. Posco Holdings Inc. in June announced a deal with China’s CNGR Advanced Material Co. to build a nickel refinery.

The agreements SK On and LG have signed are in the early stages and contract terms aren’t finalized yet, pending final IRA details, company spokespeople said.

Geopolitical Risk

Partnerships with Chinese firms can be risky for Korean companies because the US could block the joint ventures from any IRA tax benefits anytime, said James Lee, an analyst at KB Securities Co.

To assuage such concerns, LG said on an earnings call in April that it would be prepared to buy out the joint venture stake from Huayou Cobalt should that happen.

Analysts in South Korea, however, believe the nation will be able to maintain its partnerships with China, at least for a while.

“The US can’t exclude Chinese firms from EV supply chains,” said James Oh, vice president at Seoul-based battery research firm SNE Research. “If they ban Korea-China partnerships, the US will never be able to make EVs.”

And meantime, Korean companies may even learn something from their Chinese partners about how to produce the bits of batteries China dominates.

“Batteries aren’t a high-tech industry like semiconductors,” said Moon Bong-sub, an official at the Saemangeum Development and Investment Agency, where Ronbay and LG Chem plan to build their plants. “It’s a good situation because South Korea can learn Chinese battery technologies.”

--With assistance from Yujing Liu.