A tool deployed by the People’s Bank of China to defend the yuan may result in some collateral damage: a weakening in demand from bond investors who like to hedge their currency exposure.

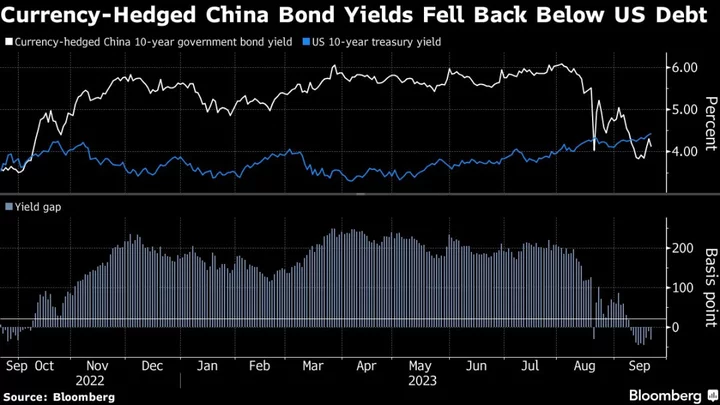

With the PBOC ramping up overseas yuan funding costs to deter short sellers, the premium that dollar-based investors enjoyed for swapping their US currency has evaporated. That has turned hedged purchases of Chinese bonds into a lower-return proposition than Treasuries. As a result, global funds which employ such a strategy may well set their sights on other bond markets instead.

The dilemma underscores how Beijing is finding it increasingly hard to shore up its beleaguered currency without paying a price. Any further drop in bond demand would spell more trouble for the Chinese debt market, which is already under pressure from the widening yield gap with the US, and mark a step back in China’s efforts to internationalize its currency.

A prolonged liquidity squeeze would “limit offshore investors’ interest in onshore bonds and slow down the process of yuan internationalization,” said Ju Wang, head of Greater China FX & rates strategy at BNP Paribas SA in Hong Kong. “Tightening offshore yuan funding could be just a temporary solution.”

For dollar-based investors, the math argues in favor of buying US government bonds instead of yuan notes. China’s currency-hedged 10-year government bonds yield little more than 4% while similar-maturity Treasuries offer close to 4.5%. US-based investors used to sell the yuan in the forward market to earn an extra yield pick-up, but this has diminished as offshore liquidity in the yuan dwindled.

Yuan funding costs have climbed after the PBOC moved to drain liquidity through increased bill issuance and state-owned banks reduced supply of the currency overseas. The cost to borrow the yuan in Hong Kong has jumped since mid-August, with the rate on three-month contracts touching a five-year high this week.

Hedged investor demand used to counter some bond outflows but “even that trade is not attractive enough now,” said Stephen Chiu, chief Asia FX and rates strategist at Bloomberg Intelligence. “There are really no good reasons to hold China bonds for global investors, when there are so many choices across the world.”

All this comes at an inopportune time for Chinese notes. Outflows from the country’s bond market gathered pace in August as overseas institutional investors cut positions. Foreign holdings of Chinese sovereign bonds dropped below 8% for the first time in four years last month, according to Bloomberg’s calculations.

Things are unlikely to improve in the near term given that higher US interest rates will continue to damp the Chinese currency’s appeal, forcing the PBOC to keep yuan funding costs elevated.

The onshore yuan has recovered some ground in recent weeks after authorities stepped up their defense of the currency, but it remains within striking distance of the 16-year low reached earlier this month. China will firmly crack down on behaviors that disrupt the market order and prevent risks of excessive adjustments in the yuan, a PBOC official said at a press briefing earlier this week.

“The hawkish FOMC outcome certainly adds a challenge to PBOC’s foreign-exchange policy,” BNP’s Wang said, “It will have to choose between stability and flexibility - in other words, if it wants to keep the yuan stable, the offshore yuan’s funding may have to stay tight for longer.”

--With assistance from Kartik Goyal.