President Xi Jinping appears set to postpone a party meeting held every five years to chart his nation’s long-term economic reform agenda, the latest example of the Chinese leader disregarding decades-old norms.

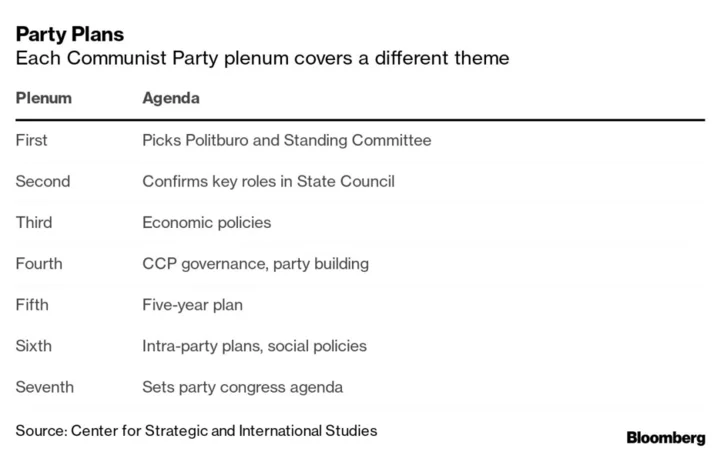

The ruling Communist Party’s Politburo skipped setting a date for the Third Plenum at its meeting this week, according to the official read out. That leaves little time for the conclave to assemble this year, prompting expectations from analysts it will be shifted to early 2024.

Delaying the meeting would mark the first time it’s been held in an off-schedule year in over three decades. The third plenum normally comes in October or November, one year after China’s new leadership team is set, according to a Bloomberg analysis of meeting readouts.

“There’s no question that convening a plenum in December would be historically unusual, but so would kicking it into next year,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics. “Xi has taken us into uncharted territory where a lot of past convention is no longer reliable.”

The party’s constitution requires its decision-making central committee to gather at least once a year, although there are no strict timetables. Xi chaired the second plenum early March to decide on the overhaul of party and government agencies.

The Chinese leader smashed party norms when he threw out de facto retirement caps and extended his decade in power last year. The ruling party’s increasingly opaque nature has become an investor concern this year, potentially undermining China’s attempts to ramp up confidence in its slowing economy.

The third plenum generally sees the new leadership team map out longer-term economic plans. Investors will be scouring the final readout for signals of potential policy pivots and future moves to steady the slowing economy.

Such meetings have catapulted major reforms: In 1978, Deng Xiaoping unveiled his “opening up and reform” strategy that paved the way for the transition from a centrally planned to a more market-driven economy, ushering in decades of rapid growth. In 1993, then-vice premier Zhu Rongji signaled greater liberalization in China when he backed a “socialist market economy” at the event.

The next third plenum may not be about the economy at all, according to Houze Song, an economist at MacroPolo, a US think tank under the Paulson Institute. He cited the 2018 meeting when party officials spoke about governance reform, adding: “The third plenum may be determined by other considerations.”

Citigroup Inc. economists led by Xiangrong Yu wrote in a note last month that they believed the third plenum could be delayed until 2024, “given the busy policy agenda ahead.”

The absence of a third plenum this month would throw a spotlight on the Central Economic Work Conference, expected in coming weeks. That meeting should contain more a detailed description of monetary, fiscal and various industrial policies for 2024.

It could also offer signs of next year’s growth targets and the budget deficit — even though the specific numbers won’t be publicized until the annual parliament session in March.

No date has been set for that event. The Politburo — a group of China’s top 24 officials — typically convenes earlier in December, and its readout will offer clues of the conclave’s agenda. The work conference usually comes between two and nine days after the Politburo huddle, according to government statements going back to 2018.

Economists generally see the official annual growth target for next year at about 4.5% or higher. That would likely require a bigger budget deficit than this year, so the government can spend more to help the economy. Analysts also expect monetary easing to step up to coordinate with fiscal stimulus, something which would be made easier if the US lowers rates in 2024.

“We expect policymakers to set an upbeat growth target of 4.5%-5% — or even ‘around 5%’ — to guide expectations and boost confidence,” Morgan Stanley economists including Robin Xing wrote in a report last month.