Two years after a crisis erupted at China’s property developers, leaving bills unpaid, homes unbuilt and creditors trying to recover the scraps from defaulted firms, a burning question remains: why are real estate tycoons still owning and running their companies?

Hui Ka Yan, the billionaire founder of China Evergrande Group, could wind up keeping almost 42% of his shares in the world’s most indebted developer, according to a restructuring proposal. Zeng Jie, also known as Baby Zeng, might ultimately retain a 45% stake in Fantasia Holdings Group Co. under an overhaul plan.

And among options that noteholders can choose from in Sunac China Holdings Ltd.’s restructuring proposal, one could result in Sun Hongbin remaining the controlling shareholder with at least 30% if all creditors subscribing to mandatory convertible bond options convert their notes into shares, according to people familiar with the matter.

The cases provide a stark contrast with practices in the US, where the likes of Uber Technologies Inc. and WeWork saw their charismatic founders quickly ousted after missteps. And while there’s no guarantee that Hui and others will survive a property meltdown that’s not yet over, investors’ initial backing for tycoons who have accumulated billions in dividends over the years is still unusual, according to market practitioners.

“What’s amazing in China’s restructurings is that creditors would accept that the promoters retain a chunky portion of the equity” and continue to manage their companies, said Tiffany Wong, managing director of Alvarez & Marsal in Hong Kong, who specializes in debt turnarounds and insolvency. “This is very different to Hong Kong or other common-law jurisdictions.”

Yet on closer examination, there is a logic behind keeping the property magnates in charge of the businesses they built. To some observers, doing so ensures that their interests remain aligned with those of bondholders to fight for the company’s survival and avoid liquidation.

“For creditors, keeping developers’ founders in the game is an important approach to bundle main shareholders’ interests with them,” said Esther Liu, an analyst at S&P Global Ratings. “If founders are kicked out, it’ll be a question whether these real estate firms can remain as a going concern.”

Another motivation may stem from a sense of obligation to set things right, according to Daniel Fan, a credit analyst at Bloomberg Intelligence.

“The chairpersons may feel personally responsible for the debt mess because they failed to follow the government guidelines to control leverage,” Fan said. “Apart from that, some founders are still passionate about their business. They want to be in control to make sure the debt plan is successful.”

Some tycoons in China have faced government scrutiny following business failures in the past. Chen Feng, the chairman and co-founder of HNA Group, was detained in 2021 after the conglomerate was seized and restructured by the Hainan government. Former Tsinghua Unigroup Chairman Zhao Weiguo was charged with corruption in March after his semiconductor company collapsed and he was ousted.

There is no suggestion of any wrongdoing by the founders of Evergrande, Fantasia and Sunac. The three developers didn’t comment when reached by Bloomberg News.

China’s real estate crisis emerged after the government began a crackdown on excessive borrowing in the industry in 2020, making it hard for developers to refinance swelling debts. The ensuing cash crunch triggered record offshore defaults, wiped out billions of dollars of investments, and delayed construction of thousands of homes.

Prior to the collapse, rapid expansion of the residential property sector made Hui and his entrepreneur peers some of the wealthiest people in the nation.

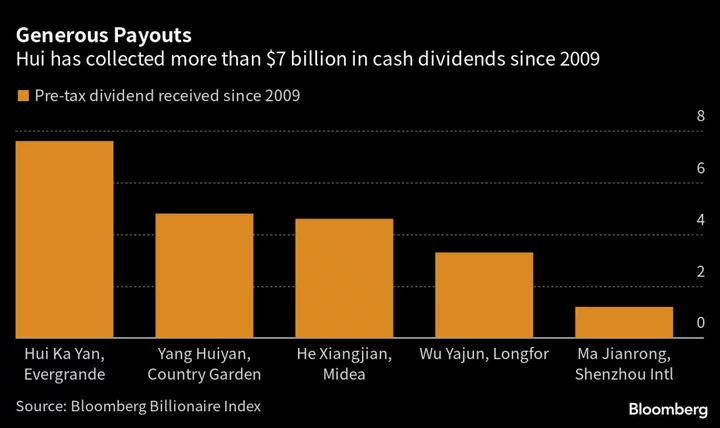

Much of Hui’s known fortune was gained from his controlling stake in Evergrande, through cash dividends he received from the company. He has pocketed about 51 billion yuan ($7.1 billion) as of 2021, the last time the giant developer announced dividends before running into a liquidity crisis.

Sought Billions

A large chunk of that wealth was wiped out in recent years — Hui is now worth about $3.2 billion, down from as much as $42 billion, according to the Bloomberg Billionaires Index. That is at risk of being further eroded by mounting lawsuits by investors.

At the same time, creditors tried unsuccessfully to get him to contribute $2 billion of his own money to the debt recovery.

“It’s disappointing to bondholders for Hui to reject cash infusion, considering how much he took out from the company in dividends over the years,” said Leonard Law, senior credit analyst at Lucror Analytics.

Yet creditors may have little choice but to keep working with founders like Hui to extract as much as they can from what’s left of their empires.

“The sponsor is active in management, while in other countries, you may have a thousand shareholders where the management is pure professional,” said Ronald Thompson, managing director and head of the Asia restructuring practice at Alvarez & Marsal.

“Ultimately, property development is very much a relationship-driven business, from acquiring the land, the permits, the licenses. Do you want the chairperson to go out and hustle for you to create value or don’t you?”

--With assistance from Venus Feng and Adrian Sim.