The $9 trillion of Chinese local government bonds that helped drag the rest of the world out of the 2008 financial crisis are a growing risk this time around.

The bonds funded an economic boom in China more than a decade ago, as local authorities borrowed heavily to invest in everything from roads to subways. But one of China’s biggest state-run investors advised asset managers overseeing its money to sell some of the debt, Bloomberg News recently reported, intensifying pressure on the securities.

It’s left authorities with the tricky balancing act of defusing a huge risk to the country’s lenders without triggering defaults and destabilizing the financial system. Any implosion of bonds from local government financing vehicles would ripple through the local banking system, further pressuring overall growth in the second largest economy in the world.

Goldman Sachs estimates that 34 trillion yuan ($4.75 trillion) of local government debt sits on the balance sheets of banks it covers. The potential headwinds to growth would hit an economy whose recovery after the pandemic has already been relatively tepid.

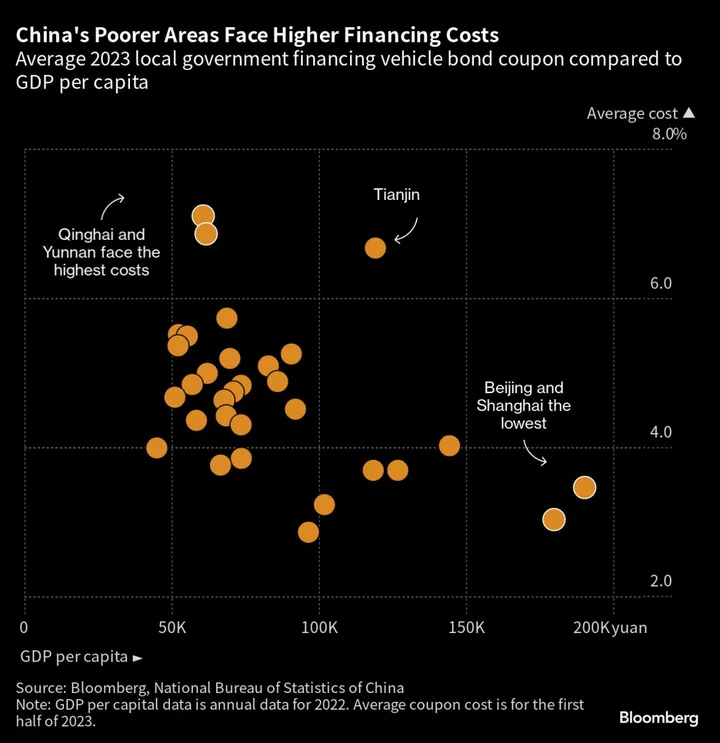

The increased risk is highlighted by the jump in the average coupon on LGFV yuan bonds to 4.39% in the first six months of the year from 3.94% last year despite the fact that China is easing monetary policy.

‘Far-Ranging Impact’

“The direct impact of LGFV default would be borne almost completely by domestic investors, but the indirect impact should be far-ranging,” said Brock Silvers, managing director at private equity firm Kaiyuan Capital. “If China’s downturn eventually runs longer or deeper because the old playbook has finally expired, the impact of LGFV profligacy will then be felt on a global economic scale.”

The latest developments add to hurdles for strained local governments in China. A nationwide property slump slashed their income from land sales while public spending jumped during the pandemic.

In a survey published last month, investors across Asia said the ballooning levels of municipal borrowing was the region’s number one financial risk this year. One of the concerns is that the money raised by the LGFVs was used on projects that typically don’t earn enough returns to cover their debts, leaving many reliant on refinancings or injections of government cash to stay afloat.

Adding to the difficulties, many LGFVs have been essentially shut out of the free trade zone bond market after recent guidance from the People’s Bank of China, a significant blow to the vehicles because they were the most prevalent issuers of those securities.

Tight Grip

The guidance shows that Beijing “continues to hold a tight grip on local debt risks and they wouldn’t want a financing channel that lacks regulatory oversight,” said Sherry Zhao, senior director, international public finance at Fitch Ratings.

It’s also left issuers from poorer provinces in particular with fewer financing options at a time when investors are souring on risk. That’s left them facing higher borrowing costs just as the average maturity for onshore LGFV bond issuance falls to the lowest since the data series began in 1999, reinforcing the pressure on regulators to defuse the trouble.

“As you get closer and closer to the center of China’s government guarantees, LGFVs are right there on that border line,” said Logan Wright, head of China markets research at Rhodium Group LLC in New York. “They’re important because if you start questioning the commitment to LGFVs, then what else are you questioning government credibility to defend?”

Week in Review

- Some of the biggest US regional banks may have to issue $168 billion of bonds at the level of their holding companies to comply with the Fed’s plan to boost capital requirements for lenders, according to Bloomberg Intelligence.

- US leveraged loan prices rose to the highest level since August as buyers focus on the secondary market while new issuance remains relatively subdued.

- A type of refinancing transaction is resurging in the $1.3 trillion market for collateralized loan obligations, a sign the industry is healing as concerns over surging inflation and a potential recession abate.

- BC Partners and a group of creditors of Keter Group BV have agreed on a deal to extend debt maturities for the maker of garden furniture, buying time for the private equity firm to sell the company and pay them back.

- Worries around debt repayments and stretched finances in billionaire Anil Agarwal’s Vedanta Resources Ltd. are once again in focus, underscored by losses in some bonds of the commodity giant.

- At least two holders of a Sino-Ocean dollar note said they didn’t receive interest due July 13, the first of nearly $380 million of bond obligations this quarter for the in-focus Chinese developer.

- Private equity firm Carlyle Group is said to be leaning toward handing over portfolio company Praesidiad Group Ltd. to a group of creditors as part of a debt restructuring.

On the Move

- Blackstone Inc. is hiring Max Besong, global head of collateralized loan obligations trading at JPMorgan Securities, according to people with knowledge of the matter.

- Boutique investment banks and law firms in Brazil are hiring as demand for advice on debt restructurings booms in Latin America’s biggest economy. Moelis & Co. hired three people this year for its Sao Paulo office, which has about 20 staff total. And Houlihan Lokey Inc. hired banker Bruno Baratta from Lazard Ltd. to start an office in Sao Paulo, where he’s building an initial team of about 10 people.

- Omar Chaudhry, who spearheaded trading of collateralized loan obligations at BNP Paribas SA, has recently exited the French lender, according to people with knowledge of the matter.

- Fidelity Investments has hired Adam Russell as a fixed-income trader in Canada, according to people familiar.

--With assistance from Wei Zhou, Taryana Odayar and Dan Wilchins.