China’s appetite for gold will stay strong through the rest of 2023, the World Gold Council said, just as domestic prices for the safe-haven soared to a record amid the strongest investment demand in more than two years.

Demand for gold bars and coins in China rose 16% year-on-year in the third quarter and will “remain robust” in the final three months, the council said in its latest outlook. Economic and political uncertainties, currency volatility and central-bank stockpiling have all fueled a buying binge.

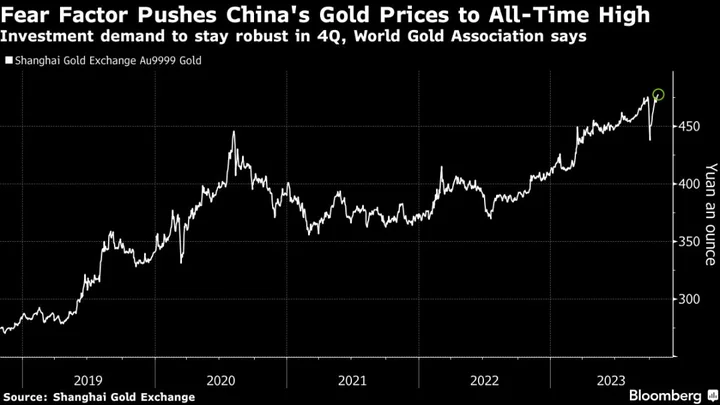

“The fragility of the domestic economic recovery, along with intensifying global geopolitical risk, could continue to support Chinese investors’ safe-haven demand for gold,” the producer-funded association said. The Shanghai Gold Exchange’s benchmark contract rallied on Tuesday to its highest ever, heading for a near-7% gain in October.

China’s demand has also been propelled by a patchy and uncertain economic recovery that’s made other assets from property to stocks less attractive. Data released Tuesday showed the country’s factory activity back in contraction for October, suggesting that the economy remains fragile.

Global gold prices last week jumped past $2,000 an ounce for the first time since May amid growing concerns over conflict in the Middle East. The precious metal, traditionally a harbor for money in times of turmoil, reached a record in mid-2020 when the Covid-19 pandemic was wreaking economic havoc worldwide.

“Gold demand has been resilient throughout this year, performing well against the headwinds of high interest rates and a strong US dollar,” the council said of the global market. “Looking forward, with geopolitical tensions on the rise and an expectation for continued robust central bank buying, gold demand may surprise to the upside.”

Gold’s allure in China will be boosted further if the People’s Bank of China continues to build reserves in what’s already one of its longest buying sprees, the report added. Still, it noted that a slightly later-than-usual Lunar New Year in 2024 might delay some demand into the first quarter of next year.