A Chinese consortium led by Contemporary Amperex Technology Co. plans to spend $1.4 billion to build lithium extraction plants in Bolivia, according to the country’s government, adding to a global rush to secure supplies of the battery material.

The group will build two facilities to make lithium chemicals with a combined production capacity of about 200,000 tons a year, Bolivia’s Ministry of Hydrocarbons and Energy said on Sunday. The investment could eventually grow to $9.92 billion, according to the statement.

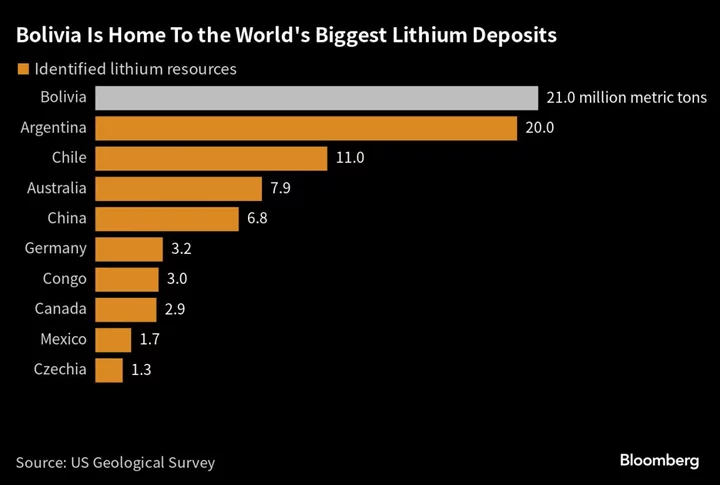

Bolivia hosts the world’s largest identified lithium deposits, but produces only a tiny amount so far. One of the Chinese-backed plants will be in Uyuni, the site of vast salt flats in southwestern Bolivia, and the other will be located in Coipasa, to the west of the country.

Global carmakers and battery manufacturers are trying to lock in future flows of battery materials including lithium, with demand poised to rise dramatically over the coming decades. CATL is the world’s biggest battery producer, with customers including Tesla Inc., Ford Motor Co. and others.

CATL didn’t immediately respond to request for comment.

CATL holds 66% of the Bolivian joint venture known as CBC, with the remainder held by its affiliates CMOC Group Ltd. — a major copper-and-cobalt producer — and Guangdong Brunp Recycling Technology Co.

The agreement builds on the group’s earlier winning bid to build so-called “direct lithium extraction” plants, or DLE, with state lithium miner Yacimientos del Litio Bolivianos.

DLE is an emerging technology which allows the metal to be extracted directly from brine rather than wait for it to evaporate. That makes it potentially much more efficient than traditional methods, according to Allan Ray Restauro, analyst at BloombergNEF.

“That being said, DLE is still a new form of technique in mining lithium and for a country like Bolivia, which has no expertise in mining lithium at all to commercial scale, commissioning and ramp up might prove to be more difficult,” he said.

Bolivia is home to 21 million tons of identified lithium deposits, according to the US Geological Survey. However, it has struggled for years to commercialize the white, powdery material trapped within the country’s giant salt flats.

The race for lithium gathered pace as lithium prices soared to a record in 2022. While the battery material has nearly halved in cost from last year, it still remains elevated compared to historical levels.

Authorities in Bolivia said CATL and its partners will be careful to not disrupt Uyuni’s salt flats, and to protect the tourism potential and environment there.

--With assistance from Danny Lee.