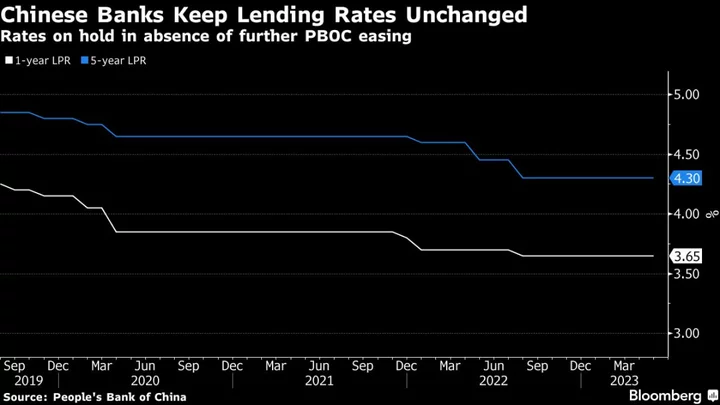

Chinese banks kept their benchmark lending rates unchanged for a ninth consecutive month following the central bank’s decision to maintain its policy rates.

The one-year loan prime rate was maintained at 3.65%, the People’s Bank of China said Monday, in line with 16 of the 18 forecasts from economists surveyed by Bloomberg. The five-year rate, a reference for mortgages, was also held at 4.3%, as most economists expected.

The PBOC kept its one-year policy rate unchanged earlier this month while injecting more long-term liquidity into the financial system. A softening in the economy’s recovery, though, has led to calls from analysts for more monetary policy support including rate cuts later this year.

Economic activity including industrial output, retail sales and fixed investment all grew at a much slower pace than expected in April, while inflation weakened to near zero and imports slumped. Credit expansion was worse than expected. Banks, which are facing weaker profitability, were asked to cap some deposit rates in a push to support the bumpy economic recovery.

The LPRs are based on the interest rates that 18 banks offer their best customers and are published by the PBOC monthly. They are quoted as a spread over the rate on the medium-term lending facility — the PBOC’s one-year loans — which has been kept unchanged since August.