August may have marked the darkest hour before dawn for China’s battered equity markets, with some investors pinning hopes that Beijing’s recent efforts to boost confidence will bear fruit in the coming days.

The CSI 300 Index, benchmark of onshore Chinese shares, has lost 5.8% this month to head for its biggest decline October. Down over 7%, an index of the nation’s stocks listed in Hong Kong is among the worst performers in 92 global equity gauges tracked by Bloomberg. Cheaper valuations and bets of more stimulus measures are giving bulls reasons to be optimistic again.

Equities were whipsawed this month as anticipation for policy support from the late-July Politburo meeting drove buyers back, but the optimism reversed rapidly as Beijing’s pro-growth messaging blitz failed to deliver swift and forceful actions. Fresh jitters over contagion from the ongoing property crisis further soured sentiment, triggering losses.

The selloff has finally eased after a package of strong steps from the securities watchdog aimed at lifting market sentiment, including the first reduction in stamp duty since 2008. The CSI 300 has gained 2% since the weekend policy boost, eying its best week in a month.

“We saw stocks massively oversold with downbeat sentiment, which has been totally divorced from fundamentals in August, but the pessimism is now reflected in the price,” said Wang Dan, chief investment officer at Shenzhen Sunrise Asset Management. “With the slew of measures recently unveiled, we expect stocks to climb upwards starting September and into the fourth quarter.”

Here are four charts to illustrate the state of play in China stocks:

Cheap valuations onshore are one reason for the budding optimism, with the benchmark trading at 11 times forward earnings, compared to a three-year average of more than 13 times. The CSI 300 is also underperforming the broader Asia equities gauge by more than six percentage points this year.

READ: Veteran Stock Picker Says China Risk-Reward Incredibly Favorable

Foreign fund outflows have been a key driver of the weakness throughout August. Investors offloaded 85.4 billion yuan ($11.7 billion) of onshore stocks via the trading links with Hong Kong this month through Wednesday. That’s set to be a record, eclipsing over 67 billion yuan worth of shares sold on a net basis during early phase of the pandemic. The pace of selling has slowed this week.

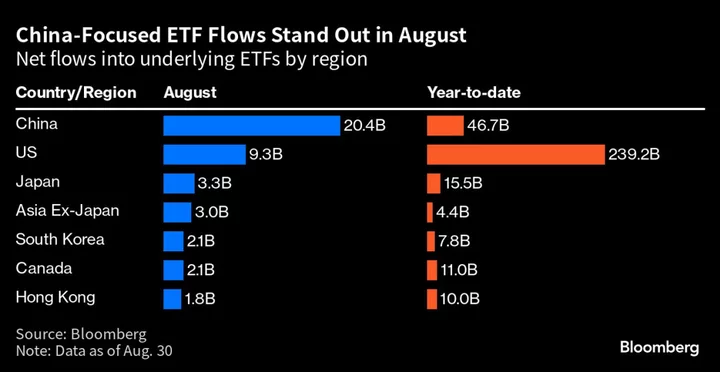

In contrast to the massive sales by foreign investors, dip-buyers onshore seem abound. An entire cohort of China-focused ETFs is seeing the highest inflow among some major world peers this month, with total purchases being more than twice that for the US, a rare feat when looking at figures compiled by Bloomberg. Some of the most-purchased products include the nation’s largest equity-focused ETF, the Huatai-Pinebridge CSI 300, and the ChinaAMC Science and Technology Innovation Board 50 ETF.

As the CSI 300 tries to regain its footing following Beijing’s market-boosting measures, more and more of the gauge’s members are emerging from oversold levels. That’s seen the ratio of members with a relative strength index reading of below 30 slide sharply after reaching the highest level since November earlier this month.