Another 10% decline in a major Chinese equity gauge may trigger a wave of selling in index futures tied to structured products, adding fresh risks to the slumping stock market.

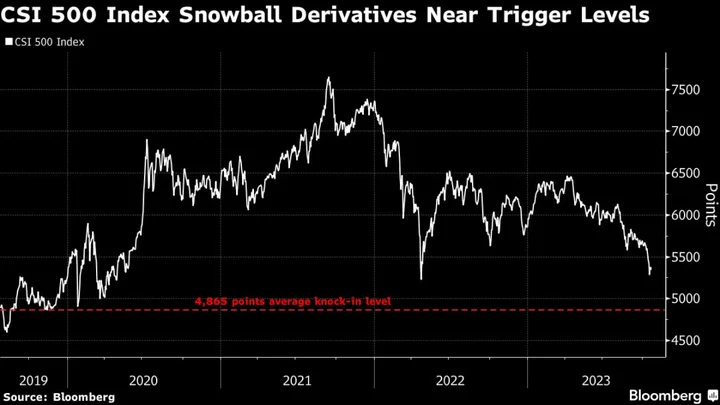

Investors face losses in complex “snowball” derivatives at maturity when a benchmark falls below a so-called knock-in level. For those tied to the CSI Smallcap 500 Index, the average threshold is 4,865, according to estimates by China International Capital Corp. The gauge closed at 5,398.93 on Thursday.

A relentless rout in Chinese stocks has turned the spotlight on the risk of those derivatives, which promise bond-like coupons as long as underlying assets trade within a certain range. Snowballs, similar to autocallables in other countries, gained popularity in 2021 among China’s institutional and wealthy investors and have expanded into a market worth $27 billion. Brokers may rush to liquidate hedging positions once the knock-in level is reached.

READ: China Rout Set to Roil $71 Billion Korea Market for Exotic Notes

Investors in South Korea, another huge market for structured notes, have billions of dollars worth of bets placed on products tied to the Hang Seng China Enterprises Index that are also at risk.

Snowball notes with the CSI 1000 as the underlying index have an average knock-in barrier at 4,997, according to CICC estimates. That’s 14% below Thursday’s close.

Chinese stocks have had a rocky year, with multiple rounds of policy stimulus failing to put a floor under the market’s slide. Persistent property woes, geopolitical tensions and a muted economic outlook have all sapped sentiment toward the nation’s assets.

The CSI 500 and CSI 1000 — the two most popular underlying indexes for snowball derivatives — have each fallen more than 7% this year. That comes after losses exceeding 20% each in 2022.

Regulators have tightened their grip on those exotic derivatives to prevent them from being marketed to retail investors as fixed-income products. The outstanding size of snowball derivatives onshore was 200 billion yuan ($27 billion) at the end of July, according to the CICC note, based on figures from the Securities Association of China.

“If there is forced selling of index futures, the impact could spill over as the drop in derivatives will hit sentiment or could force closing of long stock positions,” said Yu Yingbo, fund manager at Shenzhen Qianhai United Fortune Fund Management Co. Ltd. Still, the regulators should be less worried due to the tighter oversight in recent years, he added.

CICC estimated that any selling of index futures triggered by the breach of knock-in levels will still have limited impact on the spot stock market, as traders will reduce positions in a “diversified manner” and the volume will be small when compared to the total futures market.