Global investors seeking to trade China’s reopening will have a new strategic tool from Monday: onshore interest-rate swaps that had an annual turnover of $3 trillion last year.

The so-called Swap Connect program between mainland China and Hong Kong will provide overseas funds with easier access to the derivatives that will help hedge their exposure to the world’s second-biggest bond market. The scheme will also enable them to bet on key money-market rates that are sensitive to China’s monetary policy.

The new program kicks off just as China’s sovereign bond market puts on a seven-week rally, with traders growing more confident the central bank will ease policy as an economic recovery stutters. The new channel also helps Beijing’s aim of opening up to more global investors after regulatory crackdowns, and rising geopolitical tensions fueled concern over the nation’s investability even after it scrapped Covid controls and re-opened its borders.

China has set a 20 billion yuan ($2.9 billion) daily limit for net trading under Swap Connect, and instruments eligible include swaps referencing the seven-day fixing repurchase rate, and the three-month and overnight Shanghai Interbank Offered Rate. HSBC Holdings Plc, Citigroup Inc. and JPMorgan Chase & Co. are among the 20 banks authorized to structure trades for foreign funds through Hong Kong.

The new program — which follows Stock Connect started in 2014 and Bond Connect in 2017 — will be jointly administered by Shanghai Clearing House, Hong Kong Exchanges & Clearing Ltd. and China Foreign-Exchange Trade System. It will initially only work in the “Northbound” direction, allowing international and Hong Kong investors to access Chinese interest-rate swaps.

Bigger Than Bonds

“The market share of overseas investors in onshore IRS after Swap Connect starts will be bigger than the China bonds holding share for sure,” said Haoao Weng, head of rates trading for onshore China at BNP Paribas SA, also one of the authorized banks. “Offshore hedge funds are constrained by their balance sheet to participate in the bond market but the enthusiasm for them to participate in the rates derivatives market will be bigger than their appetite for the bonds.”

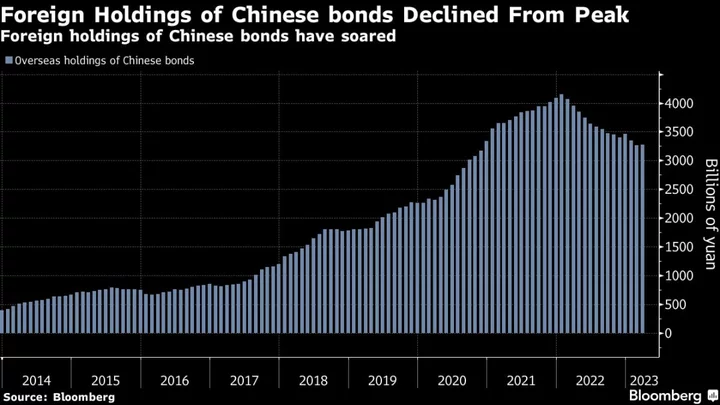

The new risk-hedging instrument is being introduced just as rising US interest rates put foreign outflow pressure on China’s bond market, with overseas funds cutting their holdings by $169 billion over the past five quarters. At the same time, global investors still own 10 times as many of the securities as they did a decade ago.

China currently allows some foreign investors access to onshore interest-rate swaps under the China Interbank Bond Market scheme, but Swap Connect will greatly broaden that ability through Hong Kong.

Narrower Spreads

One impact of the Swap Connect scheme will be to reduce demand from overseas investors for offshore interest-rate swaps, which have wider bid-ask spreads than onshore ones due to their thinner liquidity.

The average bid-ask spread is 0.25 basis points for seven-day repurchase rate interest-rate swaps, versus 1.5 basis points offshore, while average daily volume for seven-day repo IRS in the one-year tenor is about 10 times compared with the comparable offshore product, Janice Xue, a rates strategist at Bank of America Corp. in Hong Kong, wrote in a note.

Special arrangements have been made for Swap Connect to overcome the difficulties of executing cross-border deals and clearing derivatives under different legal systems. The final trading rule removed mandatory requirements for investors to sign an extra master agreement versus a draft one, while Shanghai Clearing House and Hong Kong Exchange’s OTC Clear subsidiary will jointly establish a Swap Connect financial resources pool to manage risk exposure with a maximum size of 4 billion yuan.

One of the biggest advantages of the program is the single margin pool between the two central clearing agencies, rather than requiring separate ones for each counterparty, which will reduce trading costs, said Chin-Chong Liew, a capital markets partner at Linklaters in Hong Kong.

Long View

While Swap Connect may not be able to immediately reverse the recent bond sales by overseas investors, its advantages will become clearer over the longer term, said Hao Hong, chief economist at Grow Investment Group in Shanghai.

“The Chinese authorities hope to woo global investors into the onshore financial market, and Swap Connect is a step forward in that direction,” Hong said. “Swap Connect alone might not be able to deter outflows in the short term, but we do think Chinese sovereign bonds will remain attractive to some foreign investors given their safety and stability.”