China needs to prevent any “hard decoupling” from the global economy as the world becomes more politically divided, according to a former adviser to the People’s Bank of China.

“Against the background of the polarization of global politics, the world economy is also seeing a rise in different blocs,” said Li Daokui, a former member of the central bank’s monetary policy committee, at the Caijing Annual Conference in Beijing on Wednesday.

Li said the world economy is effectively divided into three parts: the US and Latin America, a Germany-led Europe and a China-headed region including Southeast Asia. Beijing should maintain its global links while expanding the bloc it leads, he added.

He cited President Xi Jinping’s Belt and Road Initiative, a $1 trillion global infrastructure investment project, and China’s engagement in the BRICS group, which recently extended its membership, as examples of this.

Li spoke alongside other prominent economic voices in China, including former PBOC deputy governor Zhu Min and Asian Infrastructure Investment Bank President Jin Liqun, about challenges to the global economy.

Economic Vibes

Earlier, Zhu warned the world is in a “gradual slowing cycle” as it deals with “scarring effects” from the coronavirus pandemic. He projected global economic growth between 2.7% and 2.8% in 2024, slightly below the International Monetary Fund’s forecast of 2.9%. “2024 will be a mediocre year for the global economy,” he added.

Li disagreed with that approach of assessing the global economy, saying the blocs he identified were experiencing vastly different cycles.

“China’s facing deflation, insufficient consumption — totally opposite from the cycle in the US,” Li said. Economic activity in the world’s second-largest economy will be stronger next year, Li said, predicting authorities will focus on stabilizing growth.

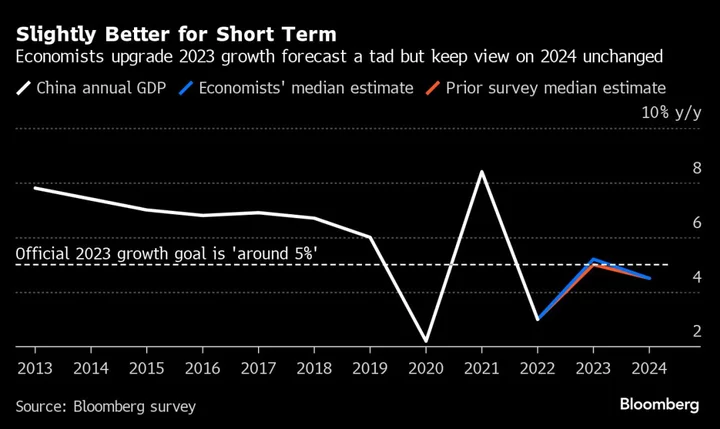

China is widely expected to surpass Beijing’s official growth goal of around 5% for this year. Commenting on a recent forecast he read, putting China’s 2023 growth forecast at 5.3% and 2024 rate at 5%, Li noted that the nation’s economic activities will be “much stronger” going into next year with policy support.

This year’s figures benefit from a “low base last year,” Li said. “So it doesn’t feel as good, and the economic activity isn’t that strong. Growth of around 5% next year will feel better than this year.”

Yuan’s Strength

Li said he believed the US dollar’s global status and impact was declining. While Federal Reserve interest rate hikes had a “psychological impact” on China this year due to currency concerns, the yuan’s exchange rate has “pulled through,” he added. The yuan has strengthened to around 7.1 per dollar now from 7.3 earlier.

Other countries, such as Brazil and Saudi Arabia, are also increasingly indicating a willingness to settle trade with China in the yuan, Li said.

China needs to step up the global infrastructure for the yuan’s use and deepen the government bond market, he said, so as to draw investment from foreign nations as they increase holdings of the currency.

Confidence Crunch

The slowdown in both household and corporate borrowing in China underscores an ongoing lack of confidence in the nation’s private sector, according to another former PBOC adviser Li Yang.

Li cited the years-long crackdown on China’s shadow banking sector and shrinking non-bank financial activities as a reason why residents increasingly shifted money from risky investments in trusts or other wealth management products to safer bank deposits. That’s led to a growing gap between household saving and debt.

On the corporate side, Li said that slower growth in companies’ demand deposits relative to time deposits reflects a decline in their willingness to spend. Corporate investment is also slowing, he added.

“Residents are not borrowing money, and that’s reflecting insufficient confidence,” said Li, referring to the flatlining household debt-to-gross domestic product ratio over the past few years.

Economists at the event also talked up the importance of rolling out fiscal policies next year to support the recovery. Robin Xing, chief China economist at Morgan Stanley, said the government should set a higher augmented fiscal deficit in 2024 — adding to a chorus of voices recommending as such.

“Considering the property sector will still likely to be weak and consumer confidence is unlikely to be fully repaired next year, excess savings accumulated over the pandemic will only be unleashed moderately,” said UBS Group AG’s Wang Tao — meaning less support for consumption growth.

Wang, the investment bank’s chief China economist, expected 2024’s official fiscal deficit target to reach as high as 3.8%.

(Updates with more panelists on confidence and fiscal policy.)