A last-minute payment on a bond earlier this week by a local government-owned firm in southwest China is adding to concerns about debt struggles.

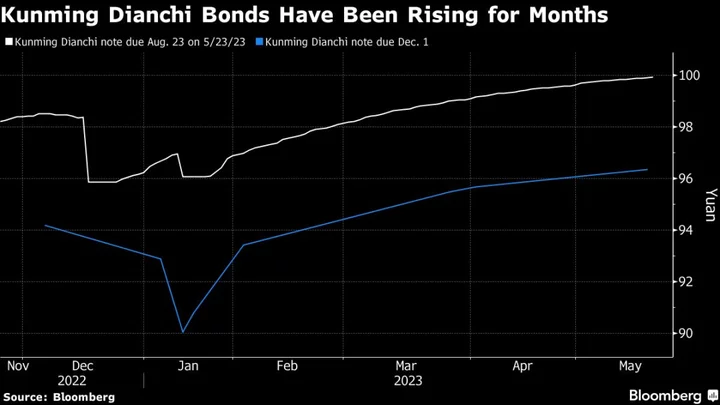

Two holders of a 1 billion yuan ($142 million) note from Kunming Dianchi Investment Co. told Bloomberg News that they received payment after business hours on the effective due date Monday. It’s unusual for onshore investors to get funds in the evening, which typically signals difficulty raising cash for debt service. Calls to the company weren’t answered.

The last-minute bond payment indicates Kunming local-government financing vehicles’ debt-servicing abilities are very weak and that future on-time repayment of public notes won’t be easy, said Yao Yu, founder of Shenzhen-based credit research company Ratingdog. Their default risks are rising, he added.

Local-government finances in Yunnan province, of which Kunming is the capital, took a heavy hit last year from slowing economic growth and China’s property market slump. General budget revenue in Kunming that includes taxes slid 27% while government-fund revenue, which is mainly income from land sales, plunged 68%.

Kunming Dianchi is owned by Kunming’s local government, with its main operations including sewage disposal and pollution treatment of one of China’s biggest lakes.

LGFVs — which fund infrastructure development in China — are one of the country’s biggest sellers of corporate debt. They issued about 5 trillion yuan last year, according to Moody’s Investors Service. No LGFV has defaulted on a public bond, even while debt failures by Chinese borrowers more broadly soared to a record for offshore notes in 2022. But there have been some scares for local borrowers as debt has topped a key threshold for a majority of regional governments.

An LGFV in Gansu province last August completed payment on a maturing bond at night, after Shanghai Clearing House issued a notice that payment hadn’t been made, a local media outlet reported at the time. The clearing house didn’t issue such a notice on Monday involving the Kunming Dianchi bond.

Worries are spreading beyond the credit market. Some onshore stock investors attributed this week’s decline to local-debt concerns, fearing a default would hit risk sentiment. The CSI 300 Index has dropped 1.9%, on pace for its sixth weekly decline in the past seven. Losses briefly pared Wednesday morning after the Kunming agency that manages state-owned assets said an LGFV meeting memo circulated online had hurt state-owned enterprises there and was “untrue.”

Lianhe Credit Rating Co. put Kunming Dianchi on negative watch last month, citing pressure from upcoming debt payments. The firm has two bonds with a combined 1.5 billion yuan of principal yet to mature this year, and investors can demand early repayment of a 1 billion yuan note in August, according to data compiled by Bloomberg. But Kunming Dianchi only had 351 million yuan of cash as of March 31, according to its quarterly report.

Other Kunming LGFVs are facing similar financial strains.

Kunming Rail Transit Group Co., which operates the city’s subway and relies heavily on government subsidies, said its cash and equivalents were just 101 million yuan as of March 31, versus 2.78 billion yuan a year earlier. Employee compensation spending was 22% lower in the first quarter, and local media outlet Jiemian has reported about social-media complaints regarding delayed salary payments.

Fitch Ratings in February identified LGFVs in 10 provincial-level regions, including Yunnan and Gansu, that it said are “more susceptible to refinancing pressure because of their sizable short-term bond maturities and higher borrowing costs.”

Yunnan has one of the highest debt-to-income ratios in China, with outstanding official debt reaching 176% of broad fiscal income by the end of 2022, according to Bloomberg calculations based on official data.

--With assistance from April Ma and Jackie Cai.

(Adds background in the fourth and 11th paragraphs.)