China’s high-yield dollar bonds are suffering their sharpest three-day selloff this year, with a fresh default from a state-backed developer underscoring how a liquidity crisis is worsening even for those with funding access.

Greenland Holding Group Co., which is partially owned by local government entities, has defaulted on a 6.75% dollar bond it guaranteed, according to a notice sent to bondholders and seen by Bloomberg News. That comes as state-backed Sino-Ocean Group Holding Ltd. proposed repaying a local note over one year.

The junk bonds overall slid about 1 cent Wednesday morning, according to credit traders. That leaves an index tracking the notes set for its worst three-day decline since November.

The declines mark a shift from last week when the gauge advanced as authorities took further steps to support the ailing sector, including an extension of outstanding loans. The market rebound though is proving to be short-lived, as a series of events and a contraction in China’s real estate sector highlighted deep-rooted debt repayment problems.

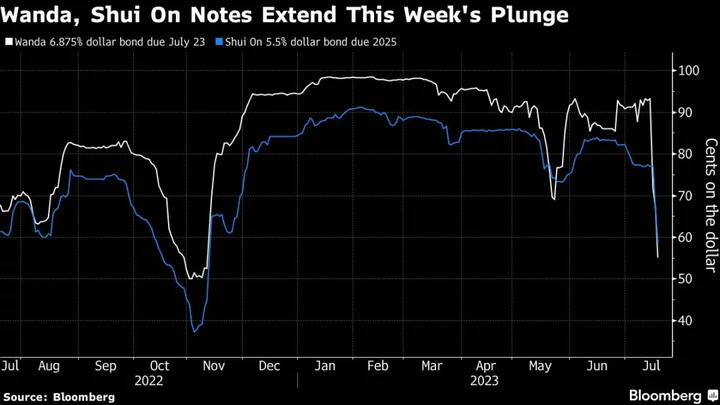

Earlier this week, Dalian Wanda Group Co. warned of a funding shortfall just days before a key dollar-bond payment. Shui On Land Ltd. added to the jitters with its move to identify bondholders, often seen as a prelude to payment delays.

The nation’s weakening property sales are heaping more pressure on developers’ finances, wrote Eric Zhu, an economist for Bloomberg Economics. “An extension of existing funding support for developers goes in the right direction but probably isn’t enough,” he said.

Hopes that the sector may be turning around as home prices gained earlier this year have fallen flat. China’s property industry contracted again in the second quarter after a short-lived expansion in the previous three months, according to a breakdown of the gross domestic product data. While some investors are looking to the Politburo meeting later this month for further policy support, the odds of a ground-breaking stimulus are slim as authorities are keen to keep a lid on leverage.

A Wanda unit’s security due July 23 plunged 11.4 cents to 56 cents on Wednesday as of 2:02 p.m. in Hong Kong, sliding deeper into the distressed territory. Shui On’s 5.5% note due 2025 slumped 10.3 cents to 57 cents.

A Bloomberg Intelligence gauge of Chinese developer shares edged higher Wednesday after closing 3% lower in the previous session.

--With assistance from Kevin Kingsbury.

(Update with Greenland Holding news from second paragraph.)