China is struggling in its attempt to lure foreigners back as data shows more direct investment flowing out of the country than coming in, suggesting companies may be diversifying their supply chains to reduce risks.

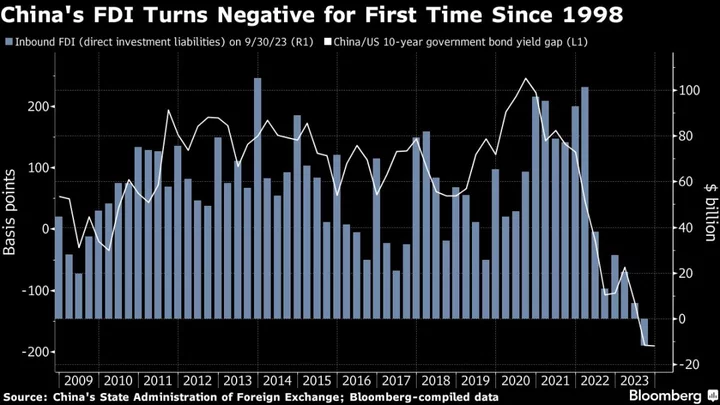

Direct investment liabilities in the country’s balance of payments have been slowing in the last two years. After hitting a near-peak value of more than $101 billion in the first quarter of 2022, the gauge has weakened nearly every quarter since. It fell $11.8 billion in the July-to-September period, marking the first contraction since records started in 1998.

“It’s concerning to see net outflows where China’s doing its best at the moment to try and open — certainly the manufacturing sector — to new inflows,” said Robert Carnell, regional head of research for Asia-Pacific at ING Groep NV. “Maybe this is the beginning of a sign that people are just increasingly looking at alternatives to China for investment.”

The Chinese government has embarked on a big push in recent months to lure foreign investment back to the country. On Wednesday, the Ministry of Commerce asked local governments to clear discriminatory policies facing foreign companies in a bid to stabilize investment confidence. It cited the need to end subsidies for local new energy vehicle brands as one example.

In August, the internet regulator met with executives from dozens of international firms to ease concerns about new data rules. The government has also pledged to offer overseas companies better tax treatment and make it easier for them to obtain visas.

But Beijing’s pledges have rung hollow for some firms, with foreign business groups decrying “promise fatigue” amid skepticism about whether meaningful policy support is forthcoming. They also have incentive to repatriate earnings overseas because of the wide gap in interest rates between China and the US, which may be pushing them to seek higher returns elsewhere.

The FDI outflows are adding pressure on the onshore yuan, which has hit the weakest level since 2007 earlier this year. China’s benchmark 10-year government bond yield is trading at 191 basis points below that of comparable US Treasuries, versus an average premium of about 100 basis points over the past decade.

“Decoupling” or “derisking” from China is an important reason for the declining FDI data reported by the State Administration of Foreign Exchange, according to Louis Kuijs, chief economist for Asia Pacific at S&P Global Ratings. Concerns about geopolitics and US-China relations were cited as major reasons for foreign corporate pessimism in a survey published in September by the American Chamber of Commerce in Shanghai.

Companies have cited various countries in the region as destinations for their supply chain shifts. Japan, India and Vietnam were floated as “top destinations gaining more attraction” in a spring survey of companies by UBS Group AG. A March AmCham report pointed to developing Asia and the US as places where members were considering moving capacity to from China.

Widespread Consequences

The lack of investment among global firms in China may have far reaching effects on the world’s second-largest economy, especially as it tries counter US curbs on access to advanced technology.

Aside from geopolitical risks, companies had also been pulling back on investment in China last year as the country rolled out pandemic restrictions. While those curbs have been removed, firms are still contending with other challenges from rising manufacturing costs in China and regulatory hurdles as Beijing scrutinizes activity at foreign corporations due to national security concerns.

“Some of the most damaging things have been the abrupt regulatory changes that have taken place,” said Carnell, pointing to this year’s anti-espionage campaign, which resulted in some firms having their offices raided by local authorities. “Once you damage the sort of perception of the business environment, it’s quite difficult to restore trust. I think it will take some time.”

Foreign companies make up less than 3% of the total number of corporations in China, but contribute to 40% of its trade, more than 16% of tax revenue and almost 10% of urban employment, state media has reported. They’ve also been key to China’s technological development, with foreign investment in the country’s high-tech industry growing at double-digit rates on average since 2012, according to the official Xinhua News Agency.

“A decline in trade and investment links with advanced economies will be a particularly significant headwind for a catching up economy such as China, weighing on productivity growth and technological progress,” Kuijs said.

Limited Optimism

There are some reasons for optimism in the coming weeks and months. President Joe Biden is set to meet with his Chinese counterpart Xi Jinping on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco later this month, which may help stabilize strained bilateral ties.

It would be helpful if increased communication yielded some “more stability and clarity on the geopolitical front,” Kuijs said, though he added it is unlikely the US will meaningfully change its policy stance.

Some economists also argue that FDI will stabilize once the China-US yield differential narrows. They also point to data on actually utilized FDI published by the Ministry of Commerce, which holds up better the SAFE data: Those figures show FDI fell 8.4% in the first nine months of this year from the same time period in 2022, to 920 billion yuan.

“I think things are not as bad as they seem from the SAFE data, otherwise policy tightening for China’s capital account management would be witnessed,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc.

In any case, China still needs to convince investors that they are welcome in the country.

“The more that it can offer a stable, conducive policy environment, the better it would be for FDI,” Kuijs said. “That includes minimizing the impact of national security-related measures on the economy and sentiment.”

--With assistance from Wenjin Lv and Evelyn Yu.

(Updates with government policy in fourth paragraph.)