As drugmakers in the US steel for price negotiations ushered in by President Joe Biden’s Inflation Reduction Act, their experience in China, where such talks started almost a decade ago, could offer some insight into just how low costs may go.

Beijing back in 2016 started to negotiate prices for newly approved drugs in order to qualify for state medical insurance coverage, as the government sought to improve access to, and affordability of, life-saving medicines for its 1.4 billion people.

According to data compiled by Frost & Sullivan and released to Bloomberg this month, that worked to slash the costs of some of the world’s blockbuster drugs, creating vast discrepancies between China and other markets.

The fate of the world’s two best-selling medicines in China, one for rheumatoid arthritis and another for cancer, likely portends the worst-case scenario for them in the US, when price negotiations kick off in just a few years.

When AbbVie Inc.’s arthritis drug Humira first entered China in 2010, its unit price was 7,600 yuan ($1,060). In China, Humira’s patent expired in 2017, but AbbVie managed to extend the protection until 2019, by which time other competitive drugs had been developed locally. When Humira was included in China’s insurance plan that same year, its price plunged to 1,290 yuan a unit, or just $180.

It’s not uncommon for Western pharma companies to make price cuts of about 60% to 70% to get on the government list of medicines that can be reimbursed by state medical insurance.

In the US, the current price per unit for Humira, available in a pre-filled syringe or an auto-inject pen, is around $3,379, the Frost & Sullivan data show.

From 2026, Biden’s Inflation Reduction Act will allow officials to negotiate prescription drug prices with pharmaceutical companies.

Health policy experts expect about 40 medicines will be subject to such haggling between that year and 2028, including Merck & Co.’s breakthrough cancer medicine, Keytruda, and its closest rival, Opdivo from Bristol-Myers Squibb Co.

Both Merck and Bristol-Myers, plus the US Chamber of Commerce, have filed suits over the law. The motion from Merck, known as MSD (Merck, Sharp & Dohme) in many parts of the world including in China, claims it’s “tantamount to extortion” and violates the Constitution.

Read more: Keytruda Profits Show Why Merck Is Suing the US

Merck’s own experience in China, meanwhile, holds both good and bad news.

While Merck has negotiated with the Chinese government over the price of Keytruda several times in the past few years, it never managed to reach an agreement. As a result, Keytruda, the best-selling cancer drug in the world, remains uncovered by China’s state-owned medical insurance, selling there for about 16 times more than the cheapest local options.

But even at $86,000, it’s still a far cry from the $200,000-a-year per patient it costs in the US, where big pharma has long argued that higher prices are necessary to incentivize future drug innovation.

Merck in response to questions from Bloomberg News said that it’s been working to get Keytruda covered by commercial insurance in China and also make it more affordable under patient assistance programs for low-income families.

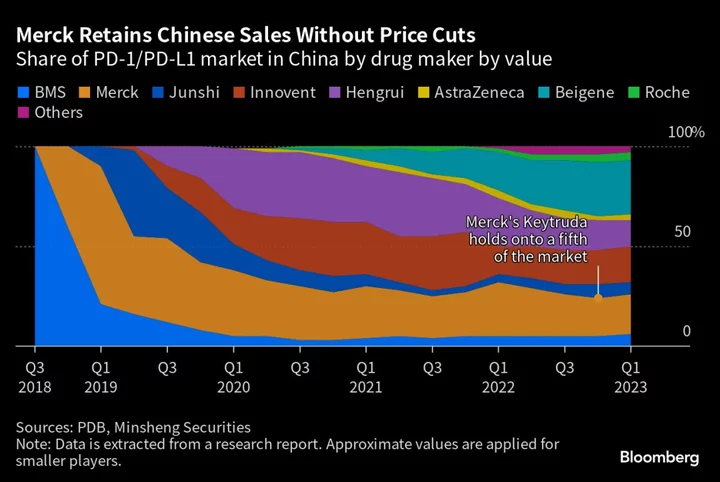

The better news for Merck in China is that Keytruda still captures about one-fifth of the category known as PD-1/PD-L1 inhibitors, which work by preventing cancer cells from escaping detection by the immune system. That’s in large part because of global studies showing how effective it is at improving and prolonging life.

“For doctors, it’s convenient and risk-free to advise patients to use an internationally well-known brand as opposed to clinically decent but domestic PD-1 drugs,” Skyler Wang, a health care industry analyst at Frost & Sullivan, said. “Even though the disposable income is low in China, families are often willing to spend a relatively high percentage of their income to pay a premium for drugs with a better brand name.”

Read more: Merck Raises 2023 Sales Forecast as Keytruda, Gardasil Surge (3)

Merck is also working to develop a self-administered version of the drug that would make it easier for patients to use, while potentially extending its patent life. That ease of administration could also spur uptake.

Propping Up Prices

The arcane structure of the American health care system currently works to prop up drug prices.

It’s difficult and expensive to bring new medicines to the market, so fresh entries are generally priced the same or more than existing therapies. Rebates demanded by insurers or companies that manage pharmacy benefits reduce drugmaker revenue, without cutting prices.

The Medicare system, which provides insurance to most of the nation’s elderly, doesn’t pay those rebates. But it also doesn’t negotiate prices, leaving it — and patients who often have to cover part of the cost — on the hook for the higher bill. The Inflation Reduction Act would change that.

In China, most people rely on state medical insurance. Drugs for cancer and other conditions were pushed to ultra-low levels after Beijing started its annual price negotiations. Those talks have made potentially life-saving medicines more affordable and widely available, but at the expense of drugmaker profit margins.

“The patient pool is absolutely huge in China,” where 95% of its 1.4 billion people are covered by national basic medical insurance, Frost & Sullivan’s Wang said. “The national insurance fund is under a heavy burden, and controlling drug prices is a must.”

China also has been more receptive to less expensive follow-on copies at least in the PD-1 market, with more than a dozen surfacing over the past six years. Their comparative benefits are less clear, however, as few studies have compared them head-to-head. That’s led doctors and patients who can afford treatment to continue to rely on high profile brands like Keytruda.

Some of these China-developed PD-1s are trying to break into the US market. Shanghai Junshi Biosciences Co. and BeiGene Ltd. have partners to help them market the drugs in the US but these drugs are still under review by the US Food and Drug Administration.

(Updated throughout)