Chinese regulators are drafting a list of 50 developers eligible for a range of financing, according to people familiar with the matter, the nation’s latest effort to put a floor under the property crisis.

China Vanke Co., Seazen Group Ltd. and Longfor Group Holdings Ltd. are among companies that have been named in a draft of the so-called white list, the people said, asking not to be named because the matter is private.

The list, which includes both private and state-owned developers, is intended to guide financial institutions as they weigh support for the industry via bank loans, debt and equity financing, the people said. It couldn’t be determined which other developers were included on the draft list.

The yet-to-be-finalized list would expand on previous rosters created by banks that only focused on some “systemically important” state-backed firms. It underscores Beijing’s growing concerns about the sector following record defaults, a swathe of unfinished apartments and a deep contraction in real estate investment that threatens to derail growth in the world’s second-largest economy.

China’s biggest banks, brokerages and distressed asset managers were told to meet all “reasonable” funding needs from property firms at a Friday gathering with the top financial regulators, according to a government statement that didn’t mention a white list. Financial firms were also asked to “treat private and state-owned developers the same” when it comes to lending.

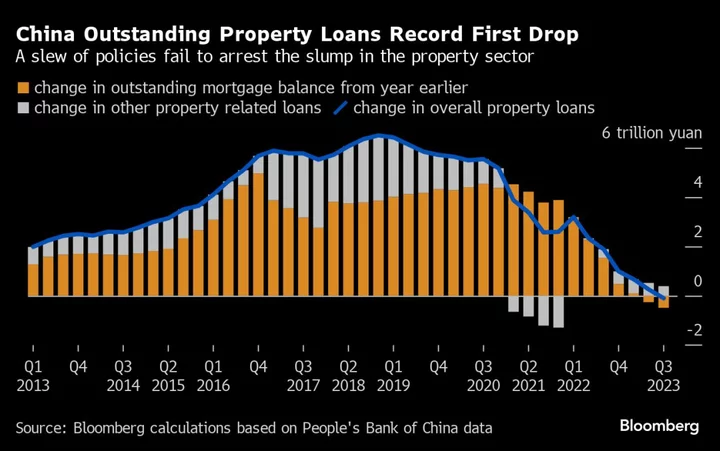

At the same event, regulators asked banks to ensure that loan issuance to private builders grows at the same rate as the industry average, people familiar with the matter said. China’s outstanding property loans at the end of September fell on a yearly basis for the first time, underlining stress in the sector.

The People’s Bank of China, the National Administration of Financial Regulation, Seazen and Longfor didn’t immediately respond to requests for comment. Vanke declined to comment.

China’s housing crisis remains a serious drag on the economy, even though other indicators such as industrial production recorded some improvement in recent months.

Instead of a bazooka, China has resorted to a trickling of policies to address property funding and sales challenges. They include mortgage-easing for homebuyers, down-payment reductions, income tax rebates, a push for urban infrastructure upgrades and affordable housing, and a 200 billion yuan special loan pledge to ensure projects are delivered. The measures however have failed to reverse the slump in the sector.

The real estate industry contracted 2.7% in the third quarter, the biggest drop this year. Home prices declined the most in eight years in October.

“The results so far are disappointing, because these measures mainly focus on boosting demand but overlook the supply side, namely, the financing needs of developers,” Macquarie Group Ltd. economists led by Larry Hu wrote in a Nov. 17 note. “A key thing to watch is whether and when policymakers would take bolder actions.”

--With assistance from Yujing Liu and Zhang Dingmin.