Chinese regulators are considering promoting the development of the domestic high-yield bond market to expand financing channels for the economy, at a time when riskier borrowers are struggling to raise money.

Officials from government agencies including People’s Bank of China and China Securities Regulatory Commission invited market participants including fixed-income investors, investment bankers, lawyers, rating firms and accountants to multiple rounds of in-person meetings in recent months to seek their suggestions on the topic, people familiar with the matter said. The PBOC and the CSRC didn’t immediately respond to requests seeking comment.

The goal is to help the credit market better serve China’s national strategy and economy, and to address challenges faced by private enterprises, the people said, asking not to be identified as the matter is private. The move comes as China considers a broad package of stimulus measures for the economy. Objectives for development of the high-yield market would include facilitating financing options for tech enterprises, startups and low-grade borrowers, according to the people. It’s unclear when any decisions would be taken.

“China’s financial system is dominated by risk-averse banks, forcing private smaller companies to seek costly equity financing,” said Li Kai, chief investment officer of Beijing Shengao Fund Management Co., which specializes in high-yield bond trading. “Some Chinese private entrepreneurs even pledge their own houses to get loans during hard times. Therefore, high-yield bonds could be a good supplement to traditional fundraising methods.”

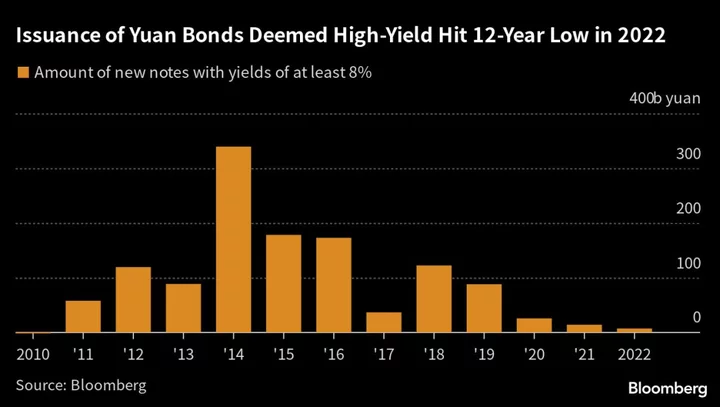

What constitutes high-yield debt can vary from country to country, but by almost any definition China’s market for the riskier securities is still relatively small. New offerings for onshore Chinese high-yield bonds have dried up, with only four priced this year with coupons of 8% or more. Such notes make up less than 1% of all outstanding yuan corporate securities, according to data compiled by Bloomberg.

That pales in comparison with the US where the outstanding amount of high-yield bonds — defined as having non-investment grade ratings — accounts for about 14% of the overall credit market. Michael Milken helped pioneer the junk note market there in the 1970s at Drexel Burnham Lambert. It expanded rapidly from the 1980s, fueling debt-financed buyouts of corporations such as the landmark $26 billion hostile takeover of RJR Nabisco.

Topics under discussion with the Chinese regulators include how to define high-yield bonds, experiences that can be learned from more mature markets in the US and Europe, and regulatory reforms to support market development, the people said. The regulators are also considering creating a new market specially designed for trading of the notes, the people added.

The potential reforms would have to address a number of challenges. In Asia, there’s a cautionary tale in Japan, where weaker companies haven’t felt compelled to sell speculative-grade notes as they’ve traditionally had close ties with banks. As a consequence the Japanese credit market has struggled to develop more of a high-yield component, after Aiful Corp. sold the country’s first yen-denominated junk bond in the public market in just 2019.

For China, there are other hurdles that have accumulated since the nation’s modern credit market took off in the 1990s. Chief among them is a long history of criticism that local credit rating firms inflate grades, failing to differentiate between different risk profiles. The government has taken more steps in recent years to scrutinize the rating industry.

Policy Shift

Regulators also ramped up efforts earlier this year to address bond underwriting problems that have long plagued the world’s second-largest fixed-income market, including large price gaps that sometimes exist between primary and secondary markets, and the practice of charging underwriting fees below market rates.

High-yield securities only emerged in China about a decade ago, after the country’s first public domestic bond default occurred in 2014 when Shanghai Chaori Solar Energy Science & Technology Co. failed to make a coupon payment. Defaults that followed created more fallen angels, as companies that have lost their investment-grade ratings are called.

That all coincided with a shift in Chinese policy to try to disabuse investors of the assumption that the government would always step in to bail out troubled borrowers. Efforts to reform the credit market also took on new urgency as authorities tried to wean the economy from its reliance on debt to fuel growth.

That all fed into the property debt crisis since 2021, when developer giant China Evergrande Group first defaulted, leading to a broader string of missed payments.

Financially weaker borrowers have consequently been essentially frozen out of international money markets and also struggle to find onshore creditors willing to help them refinance obligations. A deeper high-yield bond market could be one potential tool for trying to deal with such issues.

--With assistance from Heng Xie, Yujing Liu, Zhang Dingmin, Zheng Wu, Natalie Harrison and Wei Zhou.

(Updates with investor’s comments and chart)