China is considering compensating utilities for all the coal-fired power they’ve built, including plants that are likely to sit idle as Beijing accelerates its transition to clean energy.

The reimbursement would come in the form of capacity fees for power users, in addition to the rates they pay on the electricity they consume, according to a draft of the plan seen by Bloomberg.

Charges would apply to industrial and commercial users from the beginning of next year. The document has been circulated by the National Development and Reform Commission to power companies for their opinions. The economic planning agency didn’t respond to calls seeking comment.

China has accelerated its build-out of coal-fired power to tackle persistent supply shortages that have crippled the economy in recent years. But much of that capacity is likely to be idle for extended periods because it’s needed only as a backup to intermittent wind and solar. That’s a cost to power plants, which already have to contend with government-mandated price caps and rising carbon costs.

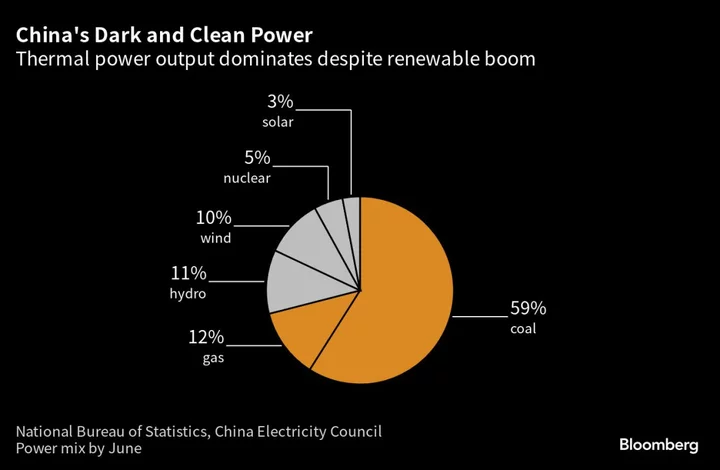

Despite the breakneck speed of China’s renewable power installations, coal still accounts for 59% of China’s electricity. President Xi Jinping’s pledge to cut coal use from 2025, a key milestone on the path to carbon neutrality, is likely to dissuade generators from expanding capacity unless they’re compensated for the effort.

The proposal could reduce losses at utilities and justify the construction of new plants, said Peng Chengyao, an analyst with S&P Global Commodity Insights.

But the potential consequences for an economy that has relied on cheap electricity to deliver much of its growth are clear.

“It will drive up power prices,” said Nannan Kou, head of China research at BloombergNEF. Allowing power plants to trade capacity is another option that’s being discussed for the future, he said.

The NDRC’s plan would allow power plants to claw back at least 30% of their fixed investment costs through 2025, via fees that range from 100 to 230 yuan ($14 to $31) per kilowatt of capacity each year. That could rise to 50% by 2026.

To be eligible for the payments, coal plants will need to be connected to the grid and compliant with their energy conservation and emissions targets. They’ll also need to be able to transfer electricity to regions short of power.

The Week’s Diary

(All times Beijing unless noted.)

Tuesday, Sept. 26

- China Intl Aluminum Week in Yinchuan, Ningxia, day 1

Wednesday, Sept. 27

- China industrial profits for August, 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- China Intl Aluminum Week in Yinchuan, Ningxia, day 2

Thursday, Sept. 28

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China Intl Aluminum Week in Yinchuan, Ningxia, day 3

Friday, Sept. 29

- China holiday

Saturday, Sept. 30

- China’s official PMIs for September, 09:30

Sunday, Oct. 1

- Caixin’s China PMIs for September, 09:45

On the Wire

Chinese developers are counting on the upcoming Golden Week holiday to spark a long-awaited revival in home sales, in the first key test of whether recent policy support can arrest the slump.

China’s property market could take as long as a year to recover, according to a former central bank adviser, who’s urging Beijing to do more to halt the spread of defaults.

The crisis at China Evergrande Group deepened Monday after the company’s mainland unit said it failed to repay an onshore bond, adding a new layer of uncertainty to the developer’s future as a restructuring plan with its offshore creditors teeters.