China-focused private equity firm Ascendent Capital Partners is considering reviving a potential offer to take Hollysys Automation Technologies Ltd. private, people familiar with the matter said, as interest in the industrial company heats up.

Ascendent Capital is working with financial advisers and exploring financing options as it evaluates a fresh bid for US-listed Hollysys, the people said, asking not to be identified discussing confidential information.

The buyout firm was among the bidders pursuing Hollysys in 2021, a process that seemed to have stalled until earlier this year. Considerations are ongoing, and it could still decide against pursuing a deal.

In August, a group of shareholders told Hollysys they’re planning to request an extraordinary general meeting to boost the size of the board and appoint new directors. Hollysys said Oct. 24 it’s evaluating their request.

Separately, a consortium of Recco Control Technology Pte and Hong Kong-based Dazheng Group Investment Holdings Co. reaffirmed their initial approach with a $1.6 billion offer, prompting Hollysys to set up a special committee and to launch a formal sale process. On Oct. 24, Hollysys said its co-chief operating officers Lei Fang and Yue Xu made a competing non-binding proposal of $25 a share, setting up a potential bidding war.

The automation firm’s shares closed 1.4% higher on Monday in New York. They have climbed 26% this year, valuing the company at $1.3 billion. A representative for Ascendent Capital couldn’t immediately be reached for comment.

Hollysys said in a press release Monday that its special board committee and advisers have been in contact with “multiple prospective buyers,” including investment firms as well as “strategic buyers for which there would be compelling industrial logic.” They’re also considering the latest bids from the Recco consortium and Hollysys management.

The company aims to identify a preferred bidder as soon as early December, according to Monday’s statement. A spokesperson for Hollysys declined to comment on renewed interest from Ascendent Capital.

“The special committee of independent directors is following a formal structured sale process with the aim of providing bidders with the opportunity to participate on a level playing field,” the Hollysys representative said in response to Bloomberg queries. “It is open to serious and compelling offers from all parties.”

Hollysys has attracted interest from private equity firms and industry players for at least three years, even after Hollysys’s board said in early 2022 that it had decided not to consider a sale of the company.

In 2021, offers came in from Ascendent Capital and Hollysys founder and current chief executive officer Changli Wang, as well as from Recco Control and Chinese private equity firm Centurium Capital, filings show. Beijing Infrastructure Investment Co., the operator of Beijing’s railway and subway, held preliminary discussions with the automation and control system manufacturer about a takeover, Bloomberg News reported in March 2022.

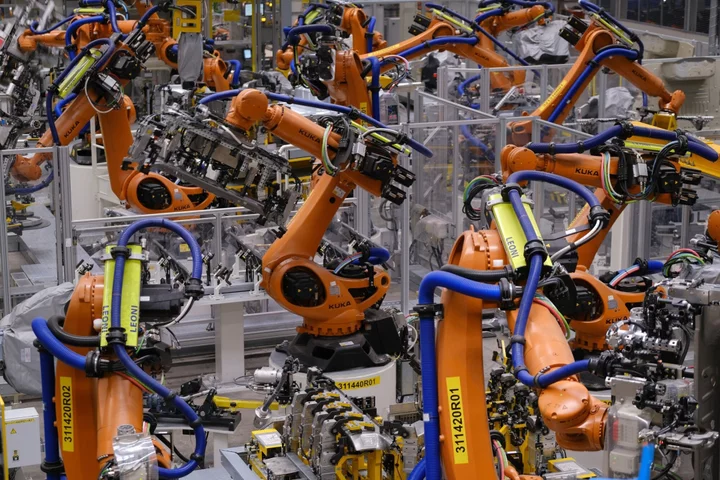

Founded in 1993, Hollysys provides integrated solutions for industrial automation and rail transport, according to its website. The Beijing-based firm operates in China and eight other countries and regions in Asia. Hollysys has worked on over 45,000 projects in sectors including power and petrochemicals as well as both high-speed and urban rail, the website shows.

Ascendent Capital was founded in 2011 by Leon Meng, a former managing director at D.E. Shaw & Co. and an ex-JPMorgan Chase & Co. investment banker. It invests in companies with a focus in China in areas such as consumer and education, health care and industrials, according to its website.

Meng also led blank-check company Silver Crest Acquisition Corp., which last year merged with the Chinese business of iconic Canadian coffee shop chain Tim Hortons, becoming a listed firm on the Nasdaq under the name TH International Ltd.

(Updates with Hollysys shares in sixth paragraph.)