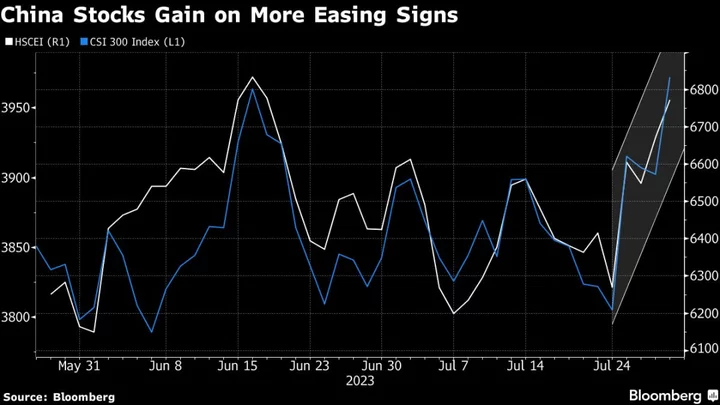

A rally in Chinese stocks is gathering steam as early signs emerge that authorities are acting on the policy pledges made at the Politburo meeting.

Equities in Hong Kong and on the mainland jumped on Friday following a report that regulators have asked the nation’s largest technology firms to provide case studies of successful startup investments, according to people familiar with the matter. That appears to be a sign authorities are ready to grant them greater leeway in backing such deals. A separate report on the possibility of a cut in stamp duties as part of efforts to boost capital markets also helped lift sentiment.

The Hang Seng China Enterprises Index, which tracks major Chinese firms listed in Hong Kong, is among the top performers this week in a list of 92 global equity indexes tracked by Bloomberg, indicating that investors are giving authorities the benefit of doubt that promises to spur growth and revitalize the private sector will be followed by actions.

“The speculation about cutting stamp duty has helped lift market sentiment today, as the move would be following the vows to boost financial markets mentioned during the politburo” meeting, said Steven Leung, executive director at UOB-Kay Hian Hong Kong.

The Hang Seng China gauge jumped as much as 2.3% on Friday. The onshore CSI 300 Index also gained more than 2%, capping its biggest weekly advance since the start of November — when an abrupt exit from Covid Zero drove a buying frenzy. Its financials sub-index rallied more than 4%.

Gains this week have been more pronounced among sectors that saw the heaviest losses in the past months — tech and property. The Hang Seng Tech Index, whose members include Internet behemoths Tencent Holdings Ltd. and Alibaba Group Holding Ltd., was on track to enter a bull market with its advance from a May low topping 20%.

“News of regulators looking into tech startups and investments may be another sign of fading regulatory headwinds and could revive deal-making in the tech sector,” said Marvin Chen, an analyst at Bloomberg Intelligence in Hong Kong. That “looks to be boosting sentiment,” he said.

That said, the jury is out on whether the stock gains will continue, and the following weeks will be crucial in determining the market’s trend. With Chinese investors burned repeatedly from policy promises that lacked implementation, another round of disappointment will further raise doubts about the market’s investability.

Read: Goldman Says Hedge Funds Bought China Stocks on Aid Pledge

For now, Beijing seems to be doing just enough to keep the rally going. Foreign investors are also snapping up mainland shares. Northbound buying through the trading links with Hong Kong had its biggest weekly inflow since January.

Volumes for call options on the HSCEI Index were double those for put contracts on Friday, according to data compiled by Bloomberg. A contract for 12% upside through March 27 was the most actively traded.

“Some portfolio managers we spoke with found Chinese stocks’ valuations very attractive,” said Claire Liang, senior manager research analyst with Morningstar Asia Ltd. “Given the already low market expectations, some believed it won’t take a lot for the market to rebound.”

--With assistance from Charlotte Yang, Ishika Mookerjee and April Ma.