For all the concern about a debt crisis facing China’s local governments, the bonds most exposed to a potential blowup are proving among the country’s best investments this year.

Some money managers are betting that debt issued by local-government financing vehicles — known as LGFVs — will benefit as Chinese authorities prioritize stabilizing economic growth, giving them an additional reason to ensure regional governments and their financing arms stay solvent.

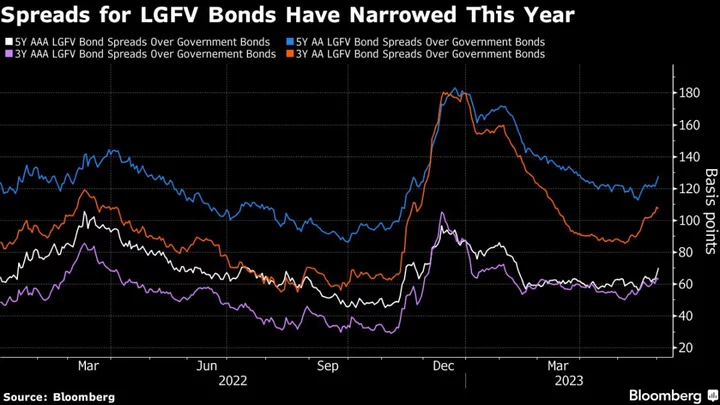

Key spreads between yuan-denominated LGFV bonds and similar-maturity sovereign debt have narrowed as much as 75 basis points this year, even after some widening in recent weeks. Meanwhile, LGFVs’ dollar notes have returned 3.9%, according to an iBoxx index, the best start to a year since 2019. Their local bond issuance has reached 2.53 trillion yuan ($357 billion), 26% more than a year earlier, data compiled by CreditSights show.

The performance has turned LGFV bonds into a surprise bright spot in Chinese markets this year as prices slide for local equities, industrial metals and the yuan amid disappointing economic data.

“The direction that the government is headed for this year is to stabilize growth, and it will be very difficult for local governments to achieve economic growth if their financing has problems,” said Li Gen, founding partner at Beijing BG Capital Management Ltd. The high-yield bond strategy at the firm, a credit specialist, has more than a third of its assets in LGFV debt.

Li, who thinks the chances of an LGFV public bond default this year are pretty small, said tight liquidity at LGFVs isn’t new. “We’ve seen examples of last-minute bond payments from them in the past few years,” he said.

Still, there are plenty of reasons to be cautious as signs build that LGFVs are struggling to stay afloat amid strained finances at regional governments.

One LGFV in the southwestern city of Kunming spooked investors in late May by delaying a bond payment until the last minute, narrowly dodging a default. Officials in Guizhou, one of China’s poorest and most-indebted provinces, stepped up their pleas for aid in April to draw Beijing’s attention to a severe debt crunch. That was after an LGFV there reached an agreement with banks to extend loan obligations by 20 years. The city of Wuhan, in central China, resorted to publicly naming hundreds of debtors in a local newspaper article last month to demand payment.

Rapid Growth

LGFVs, which are investment companies tasked with funding government infrastructure projects, were originally established to evade a ban on local governments borrowing from banks. Years of rapid expansion have resulted in them becoming a significant chunk in a murky corner of China’s debt market. LGFVs’ total debt now amounts to about 66 trillion yuan, or 53% of the country’s gross domestic product, according to an International Monetary Fund report released in February.

The situation is becoming increasingly alarming at a time local-government finances are strained after three years of strict pandemic controls and a property-sector slump that cut into land sales, a key revenue source. A majority of regional governments had outstanding borrowings in excess of 120% of their income in 2022, according to Bloomberg calculations based on available official data.

‘Strong Willingness’

So far, the authorities appear to be tackling the issue, sending a signal they are looking to avoid public defaults.

A delegation from Shanghai visited Yunnan last month to “discuss future cooperation opportunities” following the near-default of an LGFV linked to the provincial capital of Kunming, according to a report in local media. In March, officials from Weifang city in Shandong province met with bond investors to boost market confidence, while China’s banking regulator vowed to address Shandong’s debt risks in February.

“Local governments have actively held talks this year to express their care for the credit-market environment and strong willingness to repay bonds,” said Jiang WenJun, a fund manager at Purekind Fund Management Co. in Shanghai.

Nearly 90% of bond investors in a Bloomberg survey last month said they don’t think an LGFV public bond default will happen this year. At the same time, 74% said they had no plan to cut their exposure to the sector during the rest of 2023.

Inevitable Default

But some say government officials can only do so much about LGFV debt.

“It’s very difficult for them to avoid defaults at this point — not because anyone’s really trying to,” said Logan Wright, head of China markets research at Rhodium Group LLC in New York. “It’s just that we know the pressure from declining land-sales revenues and the pressure from zero-Covid related expenditures, which aren’t going away.”

“The ingredients are there for a default at some point. It is just a question of what happens when inevitably there is an LGFV bond default. What are they going to do to respond?”

--With assistance from Rebecca Choong Wilkins.