One of China’s top battery makers, Gotion High-Tech Co., says globalization is an irresistible trend and that protectionist policies are only short term.

“You have to share the technology and product with other countries in the world, that is the fundamental economic side of it,” Chairman Li Zhen said Friday at the Bloomberg New Economy Forum in Singapore.

“American companies have to interact with other companies in the world,” Li said, “In the future, I don’t think the Inflation Reduction Act or other policies can completely stop companies from going global. Companies thrive through competition, not through subsidies.”

Geopolitical tensions and climate policies including the passage of the US Inflation Reduction Act have spurred a rethink in the global electric-vehicle battery industry. The IRA offers tax credits for cars built in the US with components mainly made domestically, while it has yet to clarify how to classify the so-called foreign entities of concern. China currently has a stranglehold over battery production and the processing of raw materials.

Gotion, which counts Volkswagen AG as its largest shareholder, has been ratcheting up overseas investments, from planning battery factories in Illinois and Michigan as well in as Morocco, to developing nickel projects in Indonesia.

“Whether it is the Inflation Reduction Act or the European bills, we are still very optimistic. Protectionism is short term, the long term is about the company products,” Li said, adding that he is “very confident” that Gotion can escape being declared a foreign entity of concern in the IRA.

“The era has come where global capital flows to areas with the highest efficiency,” he said. “Global knowledge and talent move to places where they are needed most.”

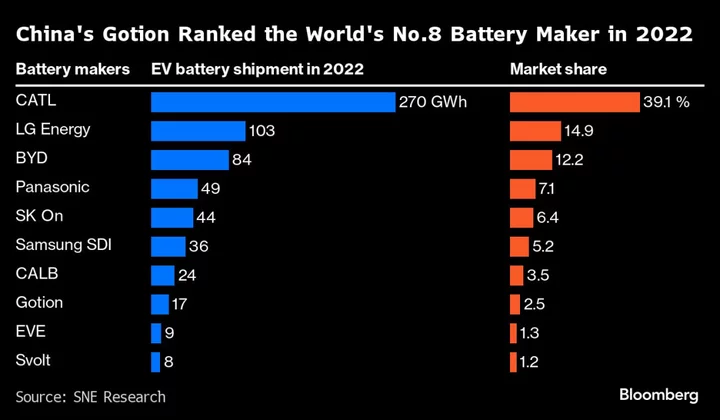

Gotion was the fourth-biggest battery maker in China in terms of shipments in 2022, and ranked the world’s No. 8, according to SNE Research. The company aims to expand its production capacity to 300Gwh in 2025, from about 100GWh last year. It’s currently supplying batteries to carmakers including VW and Geely Automobile Holdings Ltd.

In June, the Chinese company unveiled a breakthrough technology for its “Astroinno” lithium-iron-manganese-phosphate battery (LMFP) that it says will power an EV for 1,000 kilometers on each charge, and will cost less than a conventional LFP battery.

“The price of battery will hinge on two things in the future — recycling and manufacturing,” Li said Friday.

Author: Annie Lee, Olivia Poh and Alfred Cang