Chinese banks have ramped up their borrowing of short-term funds, a sign that fears of a cash crunch still loom large even as Beijing sought to calm traders after a recent liquidity squeeze.

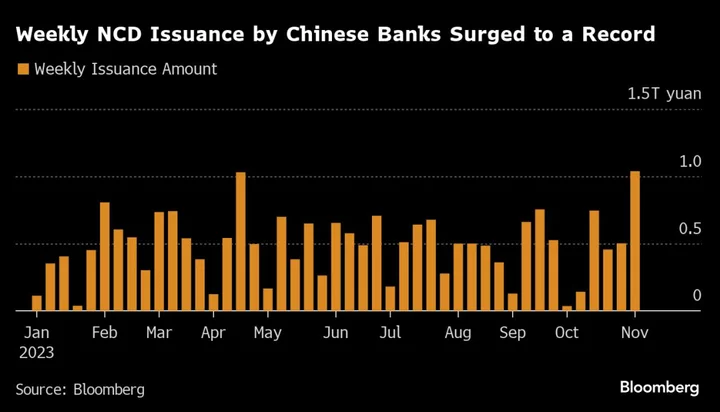

Onshore lenders this week doubled their issuance of so-called negotiable certificates of deposit, a form of debt with maturities from one to 12 months, to more than 1 trillion yuan ($137 billion). That’s the largest weekly issuance of such debt on record, according to data compiled by Bloomberg.

The rush is taking place despite borrowing costs at a six-month high in the NCD market. Even some state-backed banks — which typically enjoy cheaper rates due to a lower chance of a default — opted to pay more. The world’s largest lender by assets, Industrial & Commercial Bank of China Ltd., sold a six-month note at the highest yield in 2023.

For a brief moment last week, the nightmare of a dramatic liquidity squeeze became reality, when some smaller financial institutions had to borrow short-term cash at a rate of 50%. Though the People’s Bank of China sought to calm nerves by saying the spike in rates was temporary, worries over scarce cash persist as the government crowds out the market with bond issuance through year-end to support the economy.

“China’s banking sector is still in large need of cash” after they increased loans and bought more government bonds, said Ming Ming, chief economist at Citic Securities Co. That motivates them to sell more NCDs and funding costs may stay at elevated levels, he said.

The PBOC is in a much better position than peers to ease policy, as China has slipped back into deflation. But the sheer size of Beijing’s government bond sales are enough to drive money market volatility.

In October, China’s central and local governments sold debt at the fastest pace this year, according to Bloomberg calculation of official data. And a rare mid-year revision to the fiscal budget allowed authorities to sell 1 trillion yuan of additional sovereign bonds to support growth in 2023.

“The accelerated bond issuance by the government is equivalent to a huge liquidity withdrawal from the banking system into the fiscal pocket,” and policymakers may want to keep an close eye on funding stress, said Serena Zhou, a senior China economist at Mizuho Securities Asia Ltd.

PBOC Governor Pan Gongsheng looked to reassure the markets again this week, reiterating at a forum in Beijing that China will use multiple monetary tools to keep liquidity reasonably ample.

The central bank will likely reduce the reserve-requirement ratio by 25 basis points to add liquidity by the end of the year, Mizuho’s Zhou said. It will also inject cash through open market operations and medium-term liquidity facilities, she added.

“The economy is still at an early stage of a recovery and a liquidity crunch may derail all this,” she said.

--With assistance from Jing Zhao.