China and Saudi Arabia signed a local-currency swap agreement worth around $7 billion, deepening their ties as countries across the Middle East and emerging markets look to shift more of their non-oil trade away from the dollar.

The nations’ central banks agreed on a three-year deal for a maximum of 50 billion yuan or 26 billion riyals, according to statements on Monday. China, which has been promoting the yuan’s use in transactions with major energy and commodity exporters, is Saudi Arabia’s biggest trade partner.

The swap arrangement will “help strengthen financial cooperation” and “facilitate more convenient trade and investment” between the countries, the People’s Bank of China said in a statement. The Saudi monetary authority said it reflects growing collaboration between the two central banks.

The deal is the latest sign of strengthening relations between Beijing and Riyadh. Though Saudi Arabia has long been one of China’s main suppliers of oil, business ties have expanded in recent years, with Saudi Aramco investing billions of dollars in China’s petrochemicals sector and the kingdom trying to attract Chinese tech companies.

Chinese President Xi Jinping visited Riyadh last year, with the two nations signing agreements-in-principle valued at $50 billion.

Saudis Look to China for Business as US Influence Wanes

They’re also working more closely on geopolitical issues. In March, China helped broker a rapprochement between Saudi Arabia and Iran. And on Monday, a Middle Eastern delegation led by the Saudi foreign minister traveled to Beijing for talks on deescalating the Israel-Hamas war.

In August, Saudi Arabia was invited into the BRICS grouping of Brazil, Russia, India, China and South Africa. It’s expected to join in January along with five other nations including Iran, the United Arab Emirates and Argentina.

Beyond Dollar

Saudi Arabia is the world’s largest oil exporter and a pillar of a petrodollar system established in the 1970s that relies on pricing crude exports in the US currency. While maintaining a peg to the dollar, it’s now also seeking to strengthen its relations with crucial trade partners including China as part of an effort to diversify the economy away from petroleum.

Still, Saudi officials have consistently played down the idea that the kingdom would start to sell its oil to China or other major importers in currencies other than the dollar. Oil and closely-related products such as diesel, chemicals and plastics account for around 90% of the kingdom’s exports.

“There is still a very deep reliance, for a very good reason, on the dollar as a basis for trade and monetary policy,” Sharif Eid, a Dubai-based money manager at Franklin Templeton, said to Bloomberg TV on Tuesday. “I don’t think that’s changing anytime soon.”

Apart from Saudi Arabia, oil producers including the UAE and Iraq are exploring ways to conduct non-oil trade without using the dollar.

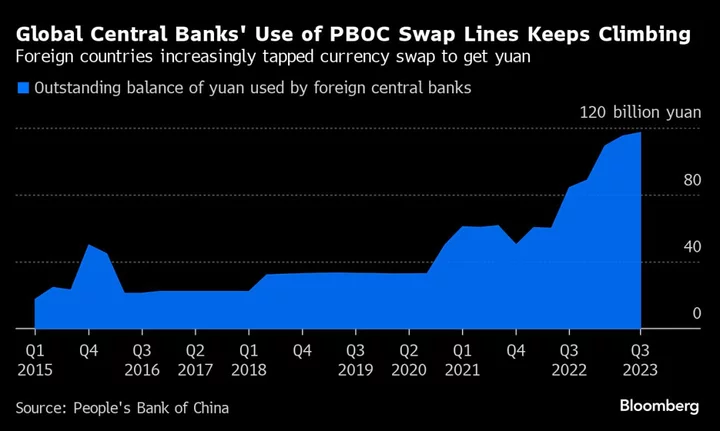

As more countries try to reduce their reliance on the US currency, China’s swaps have grown in importance. Global central banks have used them to a record degree this year.

The outstanding balance of China’s foreign-exchange swap lines rose to a fresh high of 117 billion yuan at the end of September, according to the PBOC. The Chinese central bank has 29 active swap agreements, with their combined quota at over 4 trillion yuan in total, according to its report last month.

Argentina recently said it would leverage a swap line to finance imports from China, responding to financial challenges linked to a selloff in the peso. Brazil has taken similar steps.

--With assistance from Phila Siu.

(Updates with comments from Franklin Templeton.)