Chile’s central bank slowed the pace of interest rate cuts and halted dollar purchases, surprising most analysts as the recent plunge in the peso and the rise of global geopolitical uncertainty stoke inflation fears.

Policymakers led by Rosanna Costa lowered borrowing costs by half a percentage point to 9% on Thursday, as expected by five of 22 analysts in a Bloomberg survey. Sixteen others had forecast a second straight reduction of three quarters of a percentage point, while one saw a full percentage-point drop.

In a statement accompanying the decision, policymakers wrote that they opted for a smaller rate cut as financial conditions have deteriorated worldwide. The central bank board also agreed to suspend its program to build up international reserves through dollar purchases that have contributed to the peso’s slide.

“US long-term interest rates have risen significantly, which has spread to all other economies. The Federal Reserve has reinforced its message of prolonged monetary tightening, without ruling out further hikes in the fed funds rate,” policymakers wrote. “This combination of factors has resulted in a global appreciation of the dollar.”

Chile is tapping the brakes on its easing cycle as the peso remains near its weakest level so far this year, making key imports such as fuels more expensive. The central bank said on Oct. 17 that the currency’s “very important” decline would be considered at the policy decision. Investors continue to see cost-of-living increases at the 3% target in 24 months as domestic activity fades.

Read more: Chile Central Bank Nods at Peso Rout in Verbal Intervention

What Bloomberg Economics Says

“The Chilean central bank’s undersized interest-rate cut, along with halts to dollar purchases and the unwind of its stock of currency forwards, shows that policymakers are worried about accumulated peso depreciation and external financial and geopolitical risks. The decision will support the peso. We now expect the central bank to cut rates more slowly than it anticipated in their base-case scenario outlined in September.”

— Felipe Hernandez, Latin America economist

— Click here for full report

Uncomfortable

The peso has weakened 12% in the past three months, raising prospects of new cost-of-living pressures in the near-term. The currency has been slammed by chances of more rate hikes in the US, economic weakness in top trading partner China and the Chilean central bank’s own easing cycle.

Policymakers had previously held borrowing costs at an over two-decade high before kicking off the easing cycle in July with a full percentage point cut.

“Uncertainty surrounding geopolitical conditions has been added,” board members wrote, noting that those risks have led to greater volatility in the price of oil.

“The domestic financial market has reacted to these global movements,” they wrote. “In the fixed-income market, long-term interest rates have risen, while the IPSA has accumulated losses. The peso has depreciated by around 9% with respect to the last meeting.”

Read more: Strong Dollar Paints EM Central Banks Into a Corner: Macro View

The peso closed down 0.8% to 933.22 per dollar on Thursday.

Policymakers’ decisions are “a clear signal that the bank is not comfortable with the peso’s trend,” said Luis Hurtado, a currency strategist at CIBC. “We expect USD/CLP to resume its downward trend toward the 920 mark and below that to 915.”

Core Inflation

In their statement, policymakers wrote that the local macroeconomic scenario has evolved in line with forecasts in the September monetary policy report. They cited limited dynamism in both consumption and investment.

Chile’s economic activity declined by 0.5% in August according to the central bank’s latest GDP proxy, while earlier this month the government cut its estimate for gross domestic product growth this year to zero.

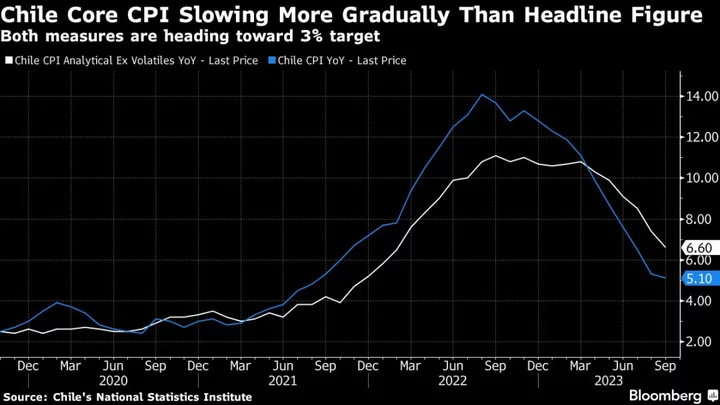

Meanwhile, weaker consumption has helped slow Chile’s annual inflation rate to 5.1%, down from the three-decade high of 14.1% recorded last year. Central bankers underscored waning core price pressures, particularly in goods.

Despite tepid activity and domestic inflation improvements, policymakers made no reference to prior guidance that rates would end this year at 7.75%-8%.

“There’s less forward guidance because there’s less certainty about what will happen next,” said Nathan Pincheira, chief economist at Fynsa in Santiago. “The central bank is worried about both global and local financial conditions.”

--With assistance from Rafael Gayol, Giovanna Serafim and Maria Elena Vizcaino.

(Re-casts story, adds details from central bank statement and economist comments starting in sixth paragraph)