Underlying inflation cooled in the US and quickened in Europe, according to the latest readings, while central bankers in both regions signaled they’re prepared to raise interest rates further.

In China, where the economy was expected to stage a huge rebound this year, the problems just keep piling up. On top of weak consumer spending and a housing slump, holiday tourism moderated last month and industrial profits are still plunging.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US & Canada

US consumer spending — the economy’s main engine — has lost steam for most of this year, portending weaker growth ahead while also helping to cool inflation. That weakness contrasts with recent data that have otherwise painted a picture of a resilient economy rather than one on the brink of recession.

Canadian inflation slowed to its weakest pace in two years and core measures edged lower, reducing — but not removing — pressure on the central bank for another interest-rate hike this month. Policymakers could be forced to raise rates again for the second straight month in July if gross domestic product and jobs figures still point to an overheated economy.

Europe

Euro-area core inflation accelerated in June to an annual gain of 5.4% from 5.3% in the prior month as the cost of services picked up markedly. With inflation initially driven by shocks including the pandemic and Russia’s war in Ukraine, concerns now center around strong demand for services such as travel, and accelerating wage gains to make up for lost income.

Germany’s business outlook deteriorated to the lowest seen this year, evidence that Europe’s biggest economy is struggling to cement a recovery after a recent recession.

Asia

It was meant to be the year China’s economy, unshackled from the world’s strictest Covid-19 controls, roared back to help power global growth. Instead, halfway through 2023, it’s facing a confluence of problems: Sluggish consumer spending, a crisis-ridden property market, flagging exports, record youth unemployment and towering local government debt.

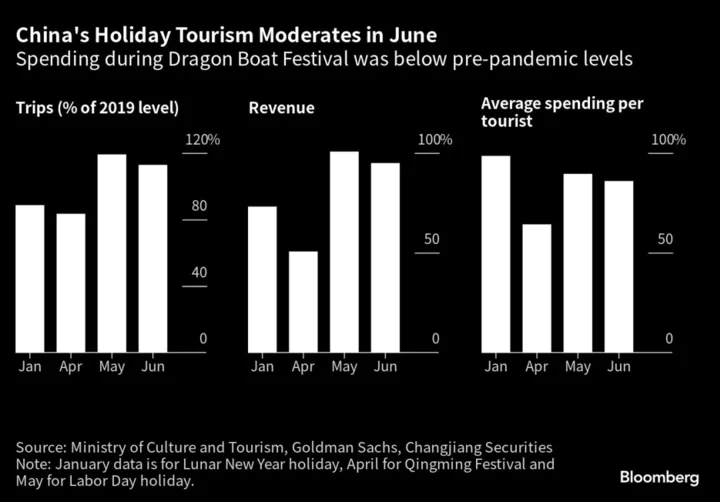

China’s consumer-driven recovery is showing more signs of losing momentum as spending slows on everything from holiday travel to cars and homes, adding to expectations for more stimulus to support the economy. Domestic travel spending during the recent holiday for the dragon-boat festival was lower than pre-pandemic levels.

Profits at industrial firms in China kept dropping in May, reflecting the impact of soft demand and ongoing factory-gate deflation. Falling profits will likely continue to weigh on business sentiment, which was already in decline.

Emerging Markets

Zimbabwe’s annual inflation rate raced to triple digits for the first time in five months after multiple devaluations of the local currency led prices to surge. The new gauge was selected as the agency said it better reflects the nation’s economic reality because it tracks prices in both US and Zimbabwean dollars, unlike the previous benchmark that only assessed costs in local-currency terms.

Pakistan clinched an initial approval from the International Monetary Fund for a $3 billion loan program, lowering the risk of a sovereign default. The IMF loans are crucial in helping the South Asian nation manage $23 billion of external debt payments for the fiscal year starting July, more than six times its foreign-exchange reserves.

World

Sweden’s Riksbank raised borrowing costs and said it expects to do so at least once more this year, while Pakistan’s central bank unexpectedly raised its rate to a record high in an emergency meeting. Kenya raised its benchmark interest rate to the highest level in seven years at an unscheduled meeting.

--With assistance from Emma Dong, Karl Lester M. Yap, John Liu, Yujing Liu, Faseeh Mangi, Godfrey Marawanyika, James Mayger, Ray Ndlovu, Reade Pickert, Randy Thanthong-Knight, Zoe Schneeweiss, Fran Wang, Allen Wan, Alexander Weber, Daniela Wei and Yihui Xie.