The Federal Reserve, European Central Bank and Bank of Japan headlined a pivotal week for central banks, with US and European policymakers opting for additional interest-rate hikes.

The Fed and ECB both lifted borrowing costs by a quarter of a percentage point while keeping options open for their next meetings in September. In Japan, the central bank made a surprise decision to loosen its yield curve control policy — a pillar of its effort to suppress interest rates and stimulate the economy. That stoked speculation of more drastic changes to the country’s ultra-low borrowing costs.

The International Monetary Fund boosted its forecast for global growth this year, adding to a growing number of voices that see a potential soft landing in the US. A report showing the world’s largest economy unexpectedly accelerated in the second quarter while inflation eased also supported that view.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

Outside of the major central banks, officials in Ghana surprised financial markets by raising borrowing costs to a record high. Nigeria’s central bank extended its longest monetary tightening in years. Indonesia stood pat while Hungary and Chile cut.

The IMF raised its outlook for the world economy this year, estimating that risks have eased in recent months after the US averted a default and authorities staved off a banking crisis on both sides of the Atlantic.

Just when consumers were starting to see some welcome news about easing inflation on the supermarket shelves, food risks are on the rise again. Concerns are growing over supplies of rice, the food staple that almost half of the global population relies on. Top exporter India banned a hefty chunk of its exports last week, sending prices in Asia to the highest level in more than three years. It’s expected that costs are set to surge even further.

US

Key measures of US inflation and labor costs cooled significantly in recent months, adding to growing optimism that the economy may be able to avoid a recession.

The US economy shined in its latest report card, supporting calls that it can dodge recession despite the most aggressive interest-rate hikes in a generation.

Locked in a fight with China for global dominance, the Biden administration is pouring subsidies into local manufacturing via landmark measures including last year’s Inflation Reduction Act. The effect has been to kickstart a global contest that’s straining alliances, threatening budgets and channeling unprecedented amounts of public cash into private companies.

Europe

Demand for loans among companies in the euro zone plunged by the most on record in the second quarter — a clear signal that the ECB’s yearlong campaign of interest-rate hikes is feeding through to the 20-nation economy.

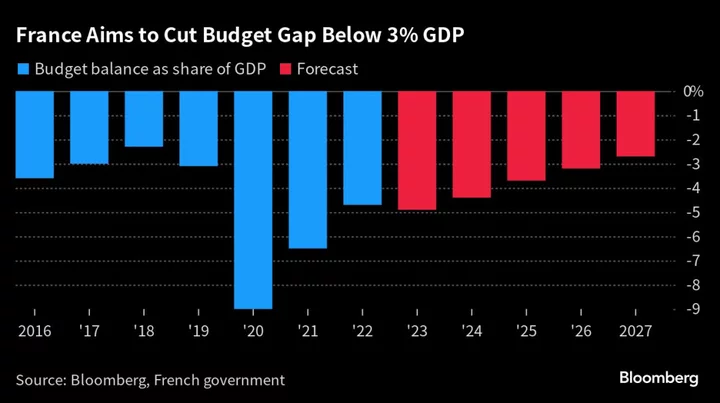

French Finance Minister Bruno Le Maire said billions of euros of promised tax cuts will be spread out gradually over several years as the government tries to reduce its budget deficit. Rising interest rates and sluggish economic growth are increasing the challenge of cutting the deficit.

Asia

South Korea’s economic growth accelerated a tad more than expected in the second quarter, with much of the gain resulting from the impact of net trade, as exports fell less than imports. Still, concerns about the strength of momentum remain.

Emerging Markets

Nigeria’s central bank raised its benchmark to a record 18.75% from 18.5%, keeping the focus on fighting inflation and disregarding a call by President Bola Tinubu for borrowing costs to be lowered.

Mexico’s inflation extended its gradual slowdown in early July, roughly in line with forecasts, helped by double-digit interest rates and the strongest peso since 2015. Consumer price increases continue to trend lower from last year’s peak, but remain above Banxico’s target of 3%, plus or minus a percentage point.

Brazil’s annual inflation eased to its lowest level in nearly three years earlier this month, clearing the way for policymakers to kick off a monetary easing cycle when they gather next week.

--With assistance from Sam Kim, Eric Martin, Ruth Olurounbi, Anthony Osae-Brown, Reade Pickert, Brian Platt, Andrew Rosati, Garfield Reynolds, Zoe Schneeweiss, Alexander Weber, Leda Alvim, Maria Eloisa Capurro, Gabrielle Coppola, Enda Curran, Agnieszka de Sousa, William Horobin and Hooyeon Kim.