Mexico’s central bankers remained cautious and avoided discussing a timeline for interest rate cuts at their last meeting, with a majority saying that it is too early to consider the start of an easing cycle even as inflation cools.

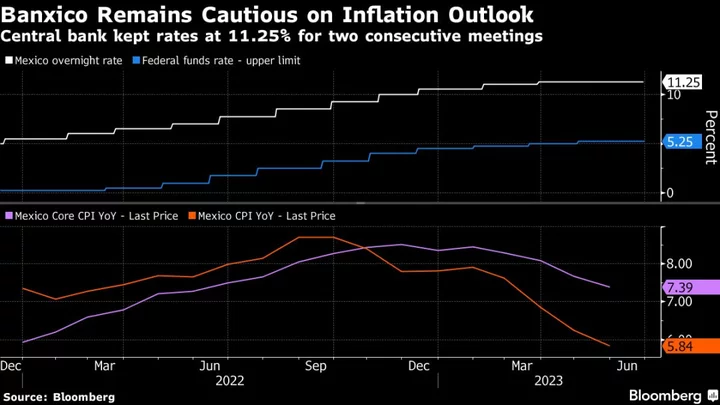

The central bank, known as Banxico, held the key rate steady at 11.25% at its June 22 meeting, during which board members expressed reservations about premature cuts in the face of an uncertain inflation outlook, according to minutes released Thursday.

“The reference rate should be maintained at its current level for a period that is long enough to ensure that inflation declines in a sustained manner,” one member said during the meeting, according to the minutes. “It is still too early to consider the possibility of interest rate cuts.”

Banxico’s decision to leave the rate unchanged for a second straight month matched the forecasts of all 25 analysts surveyed by Bloomberg. In May, the central bank paused a record 725-basis point hiking campaign that began in June 2021. Borrowing costs are at their highest level since the bank started targeting inflation in 2008.

Inflation is cooling steadily, but remains above Banxico’s target of 3%, plus or minus a percentage point. Mexico watchers are keenly awaiting the June inflation report posted Friday, which economists expect to show further deceleration in consumer price increases.

Banxico had previously signaled that it would need to maintain high rates for an extended period of time to bring inflation under control. How long that period might be “should remain undefined until there is greater certainty about an improvement in the inflationary outlook,” one member said during the meeting.

“Banxico is being held hostage by market expectations,” Joan Enric Domene, senior economist at Oxford Economics, said ahead of the release. “The market forecast for the horizon is not changing and it’s still really high, so Banxico might not feel comfortable to cut rates.”

Inflation in Latin America’s second-largest economy is expected to finish 2023 at 4.8%, according to a Citibanamex survey published Wednesday, down from a forecast of 5% in early June. Economists see interest rates at 11% at year-end and expect the economy to grow 2.3%, up from 2% last month.

“The probability of cuts toward the end of this year has increased, but it will also depend on the evolution of inflation,” Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa, said before the minutes were released.

--With assistance from Rafael Gayol.