A reversal in the fortunes for shares of Cathay Pacific Airways Ltd. and Singapore Airlines Ltd. may extend further as Hong Kong’s flagship carrier springs back to life after years of pandemic restrictions.

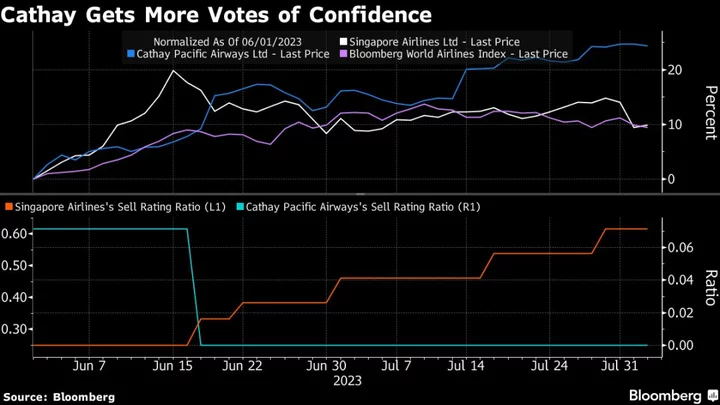

A jump in buy recommendations in July for Cathay has pushed the ratio of bullish views to the most in more than a decade thanks to cheap valuations and the prospect of a return to profit. Meanwhile, a flurry of downgrades since June due to valuation concerns has hurt sentiment for Singapore Airlines.

Read More: Cathay Pacific Forecasts Bumper Profit With Bonuses for Staff

The outlook for the battered Hong Kong carrier has started to turn around following its profit forecast for the first six months of 2023, which will end a run of losses as the airline buckled under the city’s harsh travel restrictions. Cathay’s shares have started to outperform its rival’s in recent weeks, and may rebound further if its earnings — scheduled for Aug. 9 — unleashes further positive momentum.

Cathay’s post-pandemic earnings power has been “underestimated” and there is “room for upward Street earnings revisions,” JPMorgan Chase & Co. analysts including Karen Li wrote in a July 24 note. The carrier preserving its leading market share in Hong Kong is a key positive, making it well-positioned to benefit from mainlanders’ long-haul transit flight demand, Li added.

Shares of Cathay have rallied 21% since the start of June, making it the best performer among Asia peers and the first time that it has beat Singapore Airlines for two consecutive months since December. Singapore Airlines, meanwhile, has risen 11% in the period, even as its year-to-date gains have trounced Cathay.

Wall Street analysts have already taken a cue. JPMorgan and HSBC Holdings Plc raised Cathay to the equivalent of buy from neutral last month, citing earnings growth on resilient travel demand. Meanwhile, Citigroup Inc. downgraded the Singapore carrier to sell from buy last month saying the company’s positive earnings outlook is priced in.

Read More: Singapore Air Trounces Cathay Pacific in Battle for the Skies

Cathay is trading at a price-to-book ratio of 1.3 times, cheaper than Singapore Airlines at 1.5 times, according to Bloomberg data. Analysts’ 12-month target price suggests 18% upside for the former from its last closing price, while the latter is already trading above the consensus projection.

There are some signs that Cathay’s rally may take a breather. Its shares were in overbought territory this week based on the 14-day relative strength index. The put-to-call ratio, which measures the level of interest in bearish options relative to bullish contracts, has started to edge higher after touching March lows.

Read More: Singapore Air Posts Record Profit With Bumper Summer to Continue

But analysts betting on an earnings revival are optimistic. “We expect the carrier to deliver more positive surprises in the near-term as consensus estimates appear muted,” said Jason Sum, an analyst at DBS Bank Ltd. “We do expect more upside from hereon.”

--With assistance from Danny Lee.